Dish Network 2004 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

We depend on EchoStar VIII to provide local channels to over 40 markets until at least such time as our EchoStar X

satellite is successfully launched which is currently expected during the fourth quarter of 2005 (Note 9). In the event

that EchoStar VIII experienced a total or substantial failure, we could transfer many, but not all, of those channels to

other in-orbit satellites.

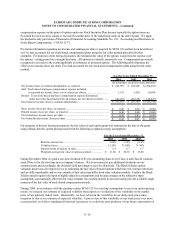

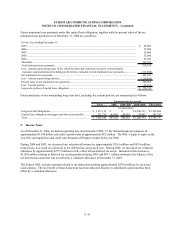

We were required to make in-orbit incentive payments in the aggregate amount of $15.0 million over a period of 14

years from launch as part of the purchase price for EchoStar VIII. These in-orbit incentive payments may be

reduced in the event that certain anomalies are experienced by the satellite. Following launch of EchoStar VIII, we

recognized the total amount of these in-orbit incentive payments by increasing the amount capitalized for the

satellite. As a result of the anomalies experienced by the satellite to date, we determined that payment of these in-

orbit incentives was no longer probable and reduced our remaining estimated obligation of approximately $13.7

million to zero as December 31, 2004 by reducing the amount capitalized for the satellite.

EchoStar IX

EchoStar IX currently operates at the 121 degree orbital location. This satellite has 32 Ku-band transponders that

operate at approximately 110 watts per channel, along with transponders that can provide services in Ka-Band (a

“Ka-band payload”). EchoStar IX provides expanded video and audio channels to DISH Network subscribers who

install a specially-designed dish. The Ka-band spectrum is being used to test and verify potential future broadband

initiatives and to implement those services.

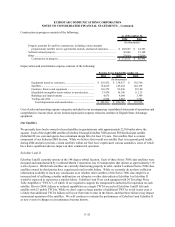

SFAS 144 requires a long-lived asset or asset group to be tested for recoverability whenever events or changes in

circumstance indicate that its carrying amount may not be recoverable. Based on the guidance under SFAS 144, we

evaluate our satellite fleet for recoverability as an asset group. While certain of the anomalies discussed above, and

previously disclosed, may be considered to represent a significant adverse change in the physical condition of an

individual satellite, based on the redundancy designed within each satellite and considering the asset grouping, these

anomalies (none of which caused a loss of service for an extended period) are not considered to be significant

events that would require evaluation for impairment recognition pursuant to the guidance under SFAS 144. Should

any one satellite be abandoned or determined to have no service potential, the net carrying amount would be written

off.

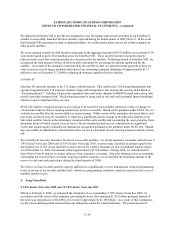

We currently do not carry insurance for any of our in-orbit satellites. To satisfy insurance covenants related to our 9

3/8% Senior Notes due 2009 and 10 3/8% Senior Notes due 2007, we previously classified an amount equal to the

depreciated cost of five of our satellites as cash reserved for satellite insurance on our consolidated balance sheets.

As of December 31, 2003, this amount totaled approximately $176.8 million. During 2004, we redeemed all of

these Notes (Note 4) and are no longer subject to these insurance covenants. Since the indentures for our remaining

outstanding notes do not have covenants requiring satellite insurance, we reclassified the remaining amount of the

reserve to cash and cash equivalents during the fourth quarter of 2004.

We believe we have in-orbit satellite capacity sufficient to expeditiously recover transmission of most programming

in the event one of our in-orbit satellites fails. However, programming continuity cannot be assured in the event of

multiple satellite losses.

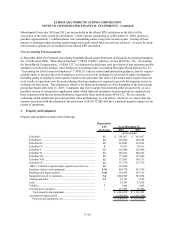

4. Long-Term Debt

9 3/8% Senior Notes due 2009 and 10 3/8% Senior Notes due 2007

Effective February 2, 2004, we redeemed the remainder of our outstanding 9 3/8% Senior Notes due 2009. In

accordance with the terms of the indenture governing the notes, the remaining $1.423 billion principal amount of

the notes was repurchased at 104.688%, for a total of approximately $1.490 billion. As a result of this redemption,

we have been discharged and released from our obligations under the related indenture. The premium paid of

F–24