Dish Network 2004 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6

Item 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND

RELATED STOCKHOLDER MATTERS

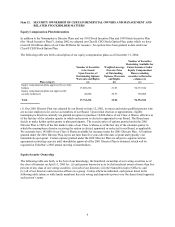

Equity Compensation Plan Information

In addition to the Nonemployee Director Plans and our 1995 Stock Incentive Plan and 1999 Stock Incentive Plan

(the “Stock Incentive Plans”), during 2002 we adopted our Class B CEO Stock Option Plan, under which we have

reserved 20 million shares of our Class B Shares for issuance. No options have been granted to date under our

Class B CEO Stock Option Plan.

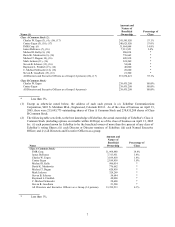

The following table sets forth a description of our equity compensation plans as of December 31, 2004:

Number of Securities

Remaining Available for

Number of Securities Weighted-average Future Issuance Under

to be Issued Exercise Price Equity Compensation

Upon Exercise of of Outstanding Plans (excluding

Outstanding Options Options, Warrants securities reflected in

Warrants and Rights and Rights column (a))

Plan category (a) (b) (c)

Equity compensation plans approved by security

holders 17,689,216

21.03

96,337,104

Equity compensation plans not approved by

security holders(1)

45,000

30.57

195,000

Total 17,734,216 21.06 96,532,104

(1) Our 2001 Director Plan was adopted by our Board on June 12, 2001, to attract and retain qualified persons who

are not our employees for service as members of our Board. Upon initial election or appointment, eligible

nonemployee directors currently are granted an option to purchase 10,000 shares of our Class A Shares, effective as

of the last day of the calendar quarter in which such person is elected or appointed to our Board. The Board may

decide to make further option grants to plan participants. The exercise price of options granted under the 2001

Director Plan is 100% of the fair market value of our Class A Shares as of the last day of the calendar quarter in

which the nonemployee director receiving the option is elected, appointed or reelected to our Board, as applicable.

We currently have 195,000 of our Class A Shares available for issuance under the 2001 Director Plan. All options

granted under the 2001 Director Plan expire not later than five years after the date of grant and typically vest

immediately upon grant. Certain options granted under the 2001 Director Plan are subject to separate written

agreements restricting exercise until shareholder approval of the 2001 Director Plan is obtained, which will be

requested at EchoStar’s 2005 annual meeting of shareholders.

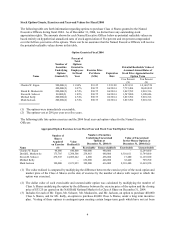

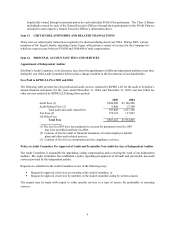

Equity Security Ownership

The following table sets forth, to the best of our knowledge, the beneficial ownership of our voting securities as of

the close of business on April 13, 2005 by: (i) each person known by us to be the beneficial owner of more than five

percent of any class of our voting securities; (ii) each of our directors; (iii) the Named Executive Officers; and

(iv) all of our directors and executive officers as a group. Unless otherwise indicated, each person listed in the

following table (alone or with family members) has sole voting and dispositive power over the shares listed opposite

such person’s name.