Dish Network 2004 Annual Report Download - page 49

Download and view the complete annual report

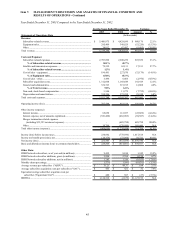

Please find page 49 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

41

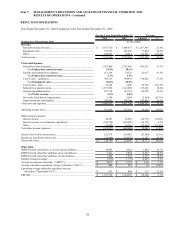

Satellite and transmission expenses. “Satellite and transmission expenses” totaled $112.2 million during the year

ended December 31, 2004, an increase of $32.9 million or 41.5% compared to the same period in 2003. This increase

primarily resulted from commencement of service and operational costs associated with the increasing number of

markets in which we offer local network channels by satellite as previously discussed, and increases in our FSS

satellite lease payment obligations. “Satellite and transmission expenses” totaled 1.7% and 1.5% of “Subscriber-

related revenue” during each of the years ended December 31, 2004 and 2003, respectively. The increase in the

expense to revenue ratio principally resulted from additional operational costs to support the commencement of service

and on-going operations of our local markets discussed above. These expenses will increase further in the future as

we increase the size of our satellite fleet, if we obtain in-orbit satellite insurance, as we increase the number and

operations of our digital broadcast centers and as additional local markets and other programming services are

launched.

Cost of sales – equipment. “Cost of sales – equipment” totaled $305.3 million during the year ended December 31,

2004, an increase of $110.8 million or 57.0% compared to the same period in 2003. This increase primarily resulted

from the increase in sales of DBS accessories to retailers and other distributors of our equipment domestically and to

DISH Network subscribers discussed above, and approximately $18.4 million in charges related to slow moving and

obsolete inventory. “Cost of sales – equipment” represented 81.8% and 65.8% of “Equipment sales,” during the years

ended December 31, 2004 and 2003, respectively. The increase in the expense to revenue ratio principally related to

the charges for slow moving and obsolete inventory discussed above, and an approximate $6.8 million reduction in the

cost of set-top box equipment during 2003 resulting from a change in estimated royalty obligations. This increase in

the expense to revenue ratio also related to a decline in margins on the sales of DBS accessories and on sales by our

ETC subsidiary to an international DBS service provider due to reductions in prices and increased sales of lower

margin accessories.

Cost of sales – other. “Cost of sales – other” totaled $33.3 million during the year ended December 31, 2004, an

increase of $29.8 million compared to the same period in 2003. This increase is primarily attributable to expenses

associated with the C-band subscription television service business of SNG we acquired in April 2004.

Subscriber acquisition costs. “Subscriber acquisition costs” totaled approximately $1.528 billion for the year ended

December 31, 2004, an increase of $215.8 million or 16.4% compared to the same period in 2003. “Subscriber

acquisition costs” during the year ended December 31, 2003 included a benefit of approximately $77.2 million

comprised of approximately $42.8 million related to a reduction in the cost of set-top box equipment resulting from a

change in estimated royalty obligations and $34.4 million from a litigation settlement. The increase in “Subscriber

acquisition costs” was attributable to a larger number of gross DISH Network subscriber additions during the year

ended December 2004 compared to the same period in 2003, partially offset by a higher number of DISH Network

subscribers participating in our equipment lease program and the acquisition of co-branded subscribers during 2004 as

discussed under “SAC and Equivalent SAC” below.

SAC and Equivalent SAC. Subscriber acquisition costs per new DISH Network subscriber activation were

approximately $444 for the year ended December 31, 2004 and approximately $453 during the same period in 2003.

SAC during the year ended December 31, 2003 included the benefit of approximately $77.2 million discussed above.

Absent this benefit, our SAC for 2003 would have been approximately $27 higher, or $480. The decrease in SAC

during the year ended December 31, 2004 as compared to the same period in 2003 (excluding this benefit) was directly

attributable to the acquisition of co-branded subscribers during 2004. Excluding the effect of co-branded subscribers,

SAC would have increased during the current year as compared to the same period in 2003. The increase in SAC

(excluding the effect of co-branded subscribers) was primarily related to more expensive promotions offered during

2004 including up to three free receivers for new subscribers and free advanced products, such as digital video

recorders and high definition receivers. Further, during 2004, since a greater number of DISH Network subscribers

activated multiple receivers, receivers with multiple tuners or other advanced products, including SuperDISH,

installation costs increased as compared to 2003. These factors were partially offset by an increase in DISH Network

subscribers participating in our equipment lease program and reduced subscriber acquisition advertising.

Penetration of our equipment lease program increased during the second half of 2004. Our capital expenditures will

continue to increase to the extent we maintain or increase our lease penetration as a percentage of new subscriber

additions. However, we believe the increase in capital expenditures from penetration of our equipment lease program

will continue to be partially mitigated by the redeployment of equipment returned by disconnected lease program