Dish Network 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

36

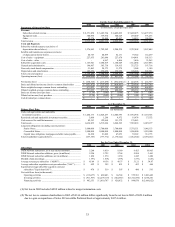

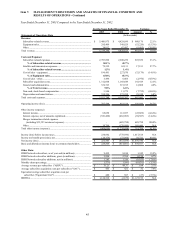

Equipment sales. “Equipment sales” consist of sales of digital set-top boxes and related components by our ETC

subsidiary to an international DBS service provider. “Equipment sales” also include unsubsidized sales of DBS

accessories to retailers and other distributors of our equipment domestically and to DISH Network subscribers.

“Equipment sales” does not include revenue from sales of equipment to SBC. Effective January 1, 2004, “Equipment

sales” includes non-DISH Network receivers and other accessories sold by our EchoStar International Corporation

subsidiary to international customers which were previously included in “Other” revenue. All prior period amounts

were reclassified to conform to the current period presentation.

Other. “Other” sales consists principally of subscription television service revenues from the C-band subscription

television service business of Superstar/Netlink Group L.L.C. (“SNG”) that we acquired in April 2004.

Subscriber-related expenses. “Subscriber-related expenses” principally include costs incurred in connection with

our in-home service and call center operations, overhead costs associated with our installation business,

programming expenses, copyright royalties, residual commissions paid to retailers or distributors, billing, lockbox,

subscriber retention and other variable subscriber expenses. Contemporaneous with the commencement of sales of

co-branded services pursuant to our agreement with SBC during the first quarter of 2004, “Subscriber-related

expenses” also include the cost of sales and expenses from equipment sales, direct costs of installation and other

services related to that relationship. Cost of sales from equipment sales to SBC are deferred and recognized over the

estimated average co-branded subscriber life. Expenses from installation and certain other services performed at the

request of SBC are recognized as the services are performed.

Satellite and transmission expenses. “Satellite and transmission expenses” include costs associated with the

operation of our digital broadcast centers, the transmission of local channels, satellite telemetry, tracking and control

services, satellite and transponder leases, and other related services.

Cost of sales – equipment. “Cost of sales – equipment” principally includes costs associated with digital set-top boxes

and related components sold by our ETC subsidiary to an international DBS service provider and unsubsidized sales of

DBS accessories to DISH Network subscribers and to retailers and other distributors of our equipment domestically.

“Cost of sales – equipment” does not include the costs from sales of equipment to SBC. Effective January 1, 2004,

“Cost of sales – equipment” includes non-DISH Network receivers and other accessories sold by our EchoStar

International Corporation subsidiary to international customers which were previously included in “Cost of sales –

other.” All prior period amounts conform to the current period presentation.

Cost of sales – other. “Cost of sales – other” principally includes programming and other expenses associated with

the C-band subscription television service business of SNG we acquired in April 2004.

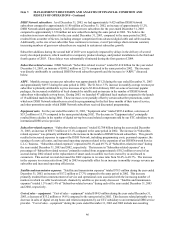

Subscriber acquisition costs. Under most promotions, we subsidize the installation and all or a portion of the cost of

EchoStar receiver systems in order to attract new DISH Network subscribers. Our “Subscriber acquisition costs”

include the cost of EchoStar receiver systems sold to retailers and other distributors of our equipment, the cost of

receiver systems sold directly by us to subscribers, net costs related to our promotional incentives, and costs related to

installation and acquisition advertising. We exclude the value of equipment capitalized under our equipment lease

program from our calculation of “Subscriber acquisition costs.” We also exclude payments and the value of returned

equipment related to disconnected lease program subscribers from our calculation of “Subscriber acquisition costs.”

SAC and Equivalent SAC. We are not aware of any uniform standards for calculating SAC and believe

presentations of SAC may not be calculated consistently by different companies in the same or similar businesses.

We calculate SAC by dividing total “Subscriber acquisition costs” for a period by the number of gross new DISH

Network subscribers during the period. We include all new DISH Network subscribers in our calculation, including

DISH Network subscribers added with little or no subscriber acquisition costs. “Equivalent SAC” adds to

“Subscriber acquisition costs” the value of equipment capitalized under our new subscriber lease program less the value

of returned equipment related to disconnected lease program subscribers, which became available for sale rather than

being redeployed through the lease program, together with payments received in connection with equipment not

returned to us.