Dish Network 2004 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

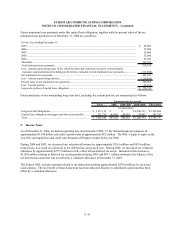

For the Years Ended December 31,

2004 2003 2002

(In thousands)

Subscriber-related............................................................ 51$ 34$ 729$

Satellite and transmission................................................ 69 359 (7)

General and administrative.............................................. 1,060 3,151 10,557

Total non-cash, stock-based compensation.................. 1,180$ 3,544$ 11,279$

Options to purchase an additional 7.0 million shares are outstanding as of December 31, 2004 and were granted

with exercise prices equal to the fair market value of the underlying shares on the date they were issued during

1999, 2000 and 2001 pursuant to a long-term incentive plan under our 1995 Stock Incentive Plan. The weighted-

average exercise price of these options is $8.90. Vesting of these options is contingent upon meeting certain longer-

term goals which have not yet been achieved. Consequently, no compensation was recorded during the years ended

December 31, 2004, 2003 and 2002 related to these long-term options. We will record the related compensation at

the achievement of the performance goals, if ever. Such compensation, if recorded, would likely result in material

non-cash, stock-based compensation expense in our consolidated statements of operations and comprehensive

income (loss).

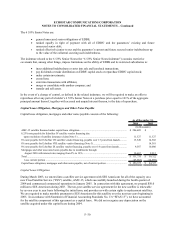

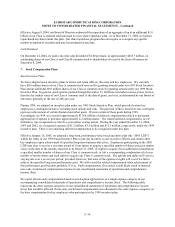

A summary of our stock option activity for the years ended December 31, 2004, 2003 and 2002 is as follows:

2004 2003 2002

Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price Options

Weighted-

Average

Exercise

Price

Options outstanding, beginning of year .......... 17,735,818 16.59$ 20,874,925 13.97$ 22,793,593 13.18$

Granted ........................................................... 4,223,000 31.64 1,354,500 29.93 532,088 20.76

Exercised ........................................................ (2,154,498) 6.64 (3,010,713) 5.75 (1,392,218) 5.30

Forfeited ......................................................... (2,125,104) 19.70 (1,482,894) 15.67 (1,058,538) 12.20

Options outstanding, end of year .................... 17,679,216 21.03 17,735,818 16.59 20,874,925 13.97

Exercisable at end of year .............................. 5,607,416 25.90 5,525,437 19.45 6,325,708 13.62

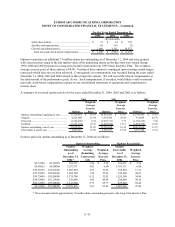

Exercise prices for options outstanding as of December 31, 2004 are as follows:

Options Outstanding Options Exercisable

Number

Outstanding

as of

December 31,

2004 *

Weighted-

Average

Remaining

Contractual

Life

Weighted-

Average

Exercise

Price

Number

Exercisable

As of

December 31,

2004

Weighted-

Average

Exercise

Price

$2.12500 - $3.00785 538,251 1.96 2.34$ 538,251 2.34$

$5.48625 - $6.00000 7,297,371 4.02 6.00 1,393,371 6.00

$10.20315 - $19.18000 1,665,594 4.57 13.92 750,594 11.71

$22.70325 - $28.88000 1,384,300 7.26 27.62 349,300 26.63

$30.75000 - $39.50000 5,374,700 8.12 32.82 1,526,300 34.88

$48.75000 - $52.75000 278,000 4.89 49.64 220,000 49.19

$60.12500 - $79.00000 1,141,000 5.31 65.77 829,600 64.44

$2.12500 - $79.00000 17,679,216 5.61 21.03 5,607,416 25.90

* These amounts include approximately 7.0 million shares outstanding pursuant to the Long-Term Incentive Plan.

F–35