Dish Network 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

43

Non-cash, stock-based compensation. During 1999, we adopted an incentive plan under our 1995 Stock Incentive

Plan, which provided certain key employees with incentives including stock options. During the year ended

December 31, 2004, we recognized $1.2 million of compensation under this performance-based plan, a decrease of

$2.4 million compared to the same period in 2003. All deferred compensation remaining as of December 31, 2003

was recognized during the quarter ending on March 31, 2004.

As discussed under “Critical Accounting Estimates” below, in December 2004, the Financial Accounting Standards

Board issued Statement of Financial Accounting Standards No. 123 (Revised 2004), “Share Based Payment”

(“SFAS 123(R)”) which is effective for financial statements as of the beginning of the first interim period that

begins after June 15, 2005. We are currently evaluating which transitional provision and fair value methodology we

will follow. However, we expect that any expense associated with the adoption of the provisions of SFAS 123(R)

will have a material negative impact on our results of operations.

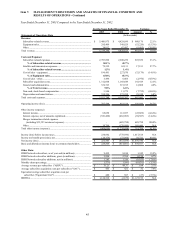

Depreciation and amortization. “Depreciation and amortization” expense totaled $502.9 million during the year ended

December 31, 2004, an increase of $104.7 million or 26.3% compared to the same period in 2003. The increase in

“Depreciation and amortization” expense primarily resulted from additional depreciation related to the

commencement of commercial operation of our EchoStar IX satellite in October 2003, and increases in depreciation

related to equipment leased to customers and other depreciable assets, including finite lived intangible assets, placed

in service during 2003 and 2004. As of December 31, 2003, EchoStar IV was fully depreciated and accordingly, we

recorded no expense for this satellite during the year ended December 31, 2004. This partially offset the increase in

depreciation expense discussed above.

Interest income. “Interest income” totaled $42.3 million during the year ended December 31, 2004, a decrease of

$22.8 million or 35.0% compared to the same period in 2003. This decrease principally resulted from lower cash and

marketable investment securities balances in 2004 as compared to 2003, partially offset by higher total returns earned

on our cash and marketable investment securities during 2004.

Interest expense, net of amounts capitalized. “Interest expense” totaled $505.7 million during the year ended

December 31, 2004, a decrease of $46.8 million or 8.5% compared to the same period in 2003. This decrease primarily

resulted from a net reduction in interest expense of approximately $98.3 million for the year ended December 31, 2004

related to the debt redemptions and repurchases of our previously outstanding senior debt during 2003 and 2004. This

decrease was partially offset by an increase in prepayment premiums and the write-off of debt issuance costs totaling

approximately $134.7 million in 2004 compared to approximately $97.1 million in 2003. See Note 4 in the Notes to

the Consolidated Financial Statements in Item 15 of this Annual Report on Form 10-K.

Other. “Other” expense totaled $13.5 million during the year ended December 31, 2004 compared to “Other”

income of $18.8 million during 2003. The decrease is primarily attributable to net losses on the sale of securities

from our marketable investments portfolio for the year ended December 31, 2004 as compared to net gains during

2003.

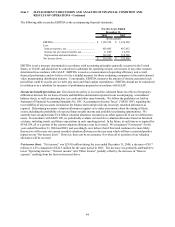

Earnings before interest, taxes, depreciation and amortization. EBITDA was $1.193 billion during the year ended

December 31, 2004, an increase of $68.2 million or 6.1% compared to $1.125 billion during the same period in 2003.

EBITDA during the year ended December 31, 2003 included a benefit of approximately $77.2 million related to the

change in estimated royalty obligations and litigation settlement discussed above. Absent this 2003 benefit, our

increase in EBITDA for the year ended December 31, 2004 would have been $145.4 million. The increase in EBITDA

(excluding this benefit) was primarily attributable to the changes in operating revenues and expenses discussed above.

EBITDA does not include the impact of capital expenditures under our new and existing subscriber equipment lease

programs of approximately $654.9 million and $118.6 million during the years ended December 31, 2004 and 2003,

respectively.