Dish Network 2004 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

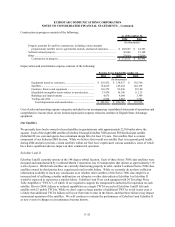

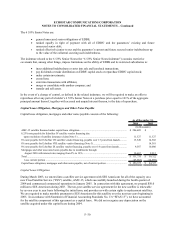

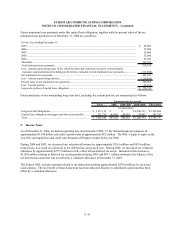

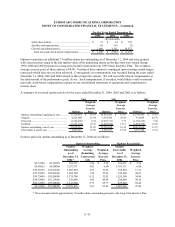

Future minimum lease payments under this capital lease obligation, together with the present value of the net

minimum lease payments as of December 31, 2004 are as follows:

For the Year Ending December 31,

2005.................................................................................................................................................................... 56,600$

2006.................................................................................................................................................................... 52,000

2007.................................................................................................................................................................... 52,000

2008.................................................................................................................................................................... 52,000

2009.................................................................................................................................................................... 52,000

Thereafter........................................................................................................................................................... 254,656

Total minimum lease payments.......................................................................................................................... 519,256

Less: Amount representing lease of the orbital location and estimated executory costs (primarily

insurance and maintenance) including profit thereon, included in total minimum lease payments................... (113,690)

Net minimum lease payments............................................................................................................................. 405,566

Less: Amount representing interest.................................................................................................................... (118,961)

Present value of net minimum lease payments.................................................................................................... 286,605

Less: Current portion......................................................................................................................................... (28,463)

Long-term portion of capital lease obligation..................................................................................................... 258,142$

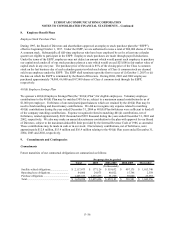

Future maturities of our outstanding long-term debt, including the current portion, are summarized as follows:

Payments due by period

Total 2005 2006-2007 2008-2009 Thereafter

(In thousands)

Long-term debt obligations............................................................. 5,471,153$ -$ -$ 2,946,153$ 2,525,000$

Capital lease obligation, mortgages and other notes payable ......... 331,735 45,062 48,885 54,041 183,747

Total .............................................................................................. 5,802,888$ 45,062$ 48,885$ 3,000,194$ 2,708,747$

5. Income Taxes

As of December 31, 2004, we had net operating loss carryforwards (“NOL’s”) for federal income tax purposes of

approximately $3.346 billion and credit carryforwards of approximately $9.2 million. The NOL’s begin to expire in the

year 2011 and capital loss and credit carryforwards will begin to expire in the year 2006.

During 2004 and 2003, we decreased our valuation allowance by approximately $76.8 million and $83.0 million,

respectively, as a result of a decrease in net deferred tax assets each year. During 2002, we increased our valuation

allowance by approximately $277.9 million to fully offset all net deferred tax assets. Included in this increase is

$210.8 million relating to deferred tax assets generated during 2002 and $67.1 million relating to the balance of the

net deferred tax asset that was not offset by a valuation allowance at December 31, 2001.

The Federal NOL includes amounts related to tax deductions totaling approximately $270.0 million for exercised

stock options. The tax benefit of these deductions has been allocated directly to contributed capital and has been

offset by a valuation allowance.

F–31