Dish Network 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

44

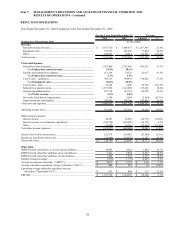

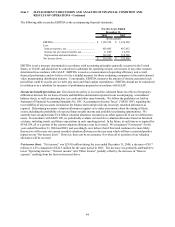

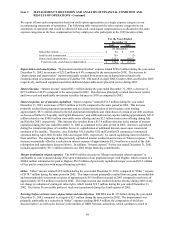

The following table reconciles EBITDA to the accompanying financial statements:

For the Years Ended

December 31,

2004 2003

(In thousands)

EBITDA............................................................... 1,192,724$ 1,124,520$

Less:

Interest expense, net .......................................... 463,445 487,432

Income tax provision (benefit), net..................... 11,609 14,376

Depreciation and amortization........................... 502,901 398,206

N

et income (loss).................................................. 214,769$ 224,506$

EBITDA is not a measure determined in accordance with accounting principles generally accepted in the United

States, or GAAP, and should not be considered a substitute for operating income, net income or any other measure

determined in accordance with GAAP. EBITDA is used as a measurement of operating efficiency and overall

financial performance and we believe it to be a helpful measure for those evaluating companies in the multi-channel

video programming distribution industry. Conceptually, EBITDA measures the amount of income generated each

period that could be used to service debt, pay taxes and fund capital expenditures. EBITDA should not be considered

in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Income tax benefit (provision), net. Our income tax policy is to record the estimated future tax effects of temporary

differences between the tax bases of assets and liabilities and amounts reported in our accompanying consolidated

balance sheets, as well as operating loss, tax credit and other carry-forwards. We follow the guidelines set forth in

Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes” (“SFAS 109”) regarding the

recoverability of any tax assets recorded on the balance sheet and provide any necessary valuation allowances as

required. Determining necessary valuation allowances requires us to make assessments about the timing of future

events, including the probability of expected future taxable income and available tax planning opportunities. We

currently have an approximate $1.0 billion valuation allowance recorded as an offset against all of our net deferred tax

assets. In accordance with SFAS 109, we periodically evaluate our need for a valuation allowance based on historical

evidence, including trends, and future expectations in each reporting period. In the future, at such time as is required by

SFAS 109, all or a portion of the current valuation allowance may be reversed. We recognized “Net income” for the

years ended December 31, 2004 and 2003, and accordingly, now believe that if this trend continues it is more likely

than not we will reverse our current recorded valuation allowance in the near term which will have a material positive

impact on our “Net income (loss).” However, there can be no assurance if or when all or a portion of our valuation

allowance will be reversed.

Net income (loss). “Net income” was $214.8 million during the year ended December 31, 2004, a decrease of $9.7

million or 4.3% compared to $224.5 million for the same period in 2003. The decrease was primarily attributable to

lower “Operating income,” “Interest income” and “Other income” partially offset by the decrease in “Interest

expense” resulting from the factors discussed above.