Dish Network 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS - Continued

47

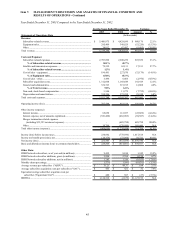

reductions in the cost of set-top box equipment of approximately $6.8 million and $6.5 million, respectively. “Cost of

sales - equipment” represented 65.8% and 65.3% of “Equipment sales,” during the years ended December 31, 2003 and

2002, respectively.

Subscriber acquisition costs. “Subscriber acquisition costs” totaled approximately $1.312 billion for the year ended

December 31, 2003, an increase of $143.4 million or 12.3% compared to the same period in 2002. The increase

principally resulted from the sale of equipment at little or no cost to the subscriber, a decrease in subscriber equipment

leases and increases in acquisition marketing as discussed under “SAC and Equivalent SAC” below. This increase

was partially offset by benefits of approximately $77.2 million which were recorded in 2003. These benefits include

approximately $34.4 million related to the receipt of a reimbursement payment for previously sold set-top box

equipment pursuant to a litigation settlement and approximately $42.8 million related to a reduction in the cost of

set-top box equipment resulting from a change in estimated royalty obligations. “Subscriber acquisition costs”

during the year ended December 31, 2002 included a benefit of approximately $47.7 million resulting from the non-

recurring reduction in the cost of set-top box equipment as a result of favorable litigation developments and the

completion of royalty arrangements with more favorable terms than estimated amounts previously accrued.

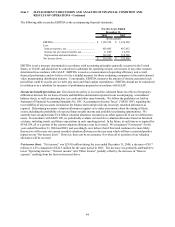

SAC and Equivalent SAC. Subscriber acquisition costs per new DISH Network subscriber activation were

approximately $453 for the year ended December 31, 2003 and approximately $421 during the same period in 2002.

As discussed above, SAC during the years ended December 31, 2003 and 2002 included benefits of approximately

$77.2 million and $47.7 million, respectively. Absent these benefits, our SAC for 2003 and 2002 would have been

approximately $27 and $17 higher, respectively, or $480 and $438, respectively. The increase in SAC (excluding these

benefits) during the year ended December 31, 2003 as compared to the same period in 2002 was primarily attributable

to an increase in the sale of equipment at little or no cost to the subscriber, including our promotion in which

subscribers are eligible to receive up to three free receivers or a free digital video recorder, together with a decrease in

subscriber equipment leases. The increase also resulted from an increase in acquisition marketing in 2003 compared

to 2002.

Equipment capitalized under our lease program for new customers totaled approximately $108.1 million and $277.6

million for the year ended December 31, 2003 and 2002, respectively. Returned equipment related to disconnected

lease program subscribers, which became available for sale rather than being redeployed through the lease program,

together with payments received in connection with equipment not returned to us, totaled approximately $30.2 million

and $37.8 million during the years ended December 31, 2003 and 2002, respectively. If we included in our calculation

of SAC the equipment capitalized less the value of equipment returned and payments received, our Equivalent SAC

would have been approximately $480 during 2003 compared to $507 during 2002. As discussed above, “Subscriber

acquisition costs” during the years ended December 31, 2003 and 2002 included benefits of approximately $77.2

million and $47.7 million, respectively. Absent these benefits, our Equivalent SAC for 2003 and 2002 would have

been $507 and $524, respectively. This decrease principally resulted from a greater percentage of returned leased

equipment being redeployed to new lease customers and relatively less of that equipment being offered for sale as

remanufactured equipment.

General and administrative expenses. “General and administrative expenses” totaled $332.7 million during the year

ended December 31, 2003, an increase of $12.8 million or 4.0% compared to the same period in 2002. The increase in

“General and administrative expenses” was primarily attributable to increased personnel and infrastructure expenses to

support the growth of the DISH Network. “General and administrative expenses” represented 5.8% and 6.6% of “Total

revenue” during the years ended December 31, 2003 and 2002, respectively. This decrease in “General and

administrative expenses” as a percent of “Total revenue” was the result of increased administrative efficiencies.

Non-cash, stock-based compensation. During 1999, we adopted an incentive plan under our 1995 Stock Incentive

Plan, which provided certain key employees with incentives including stock options. During the year ended

December 31, 2003, we recognized $3.5 million of compensation under this performance-based plan, a decrease of

$7.7 million compared to the same period in 2002. This decrease was primarily attributable to proportionate vesting

and stock option forfeitures resulting from employee terminations. The remaining deferred compensation of $1.2

million as of December 31, 2003 was recognized over the remaining vesting period, ending on March 31, 2004.