Dish Network 2004 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

The 6 5/8% Senior Notes are:

• general unsecured senior obligations of EDBS;

• ranked equally in right of payment with all of EDBS’ and the guarantors’ existing and future

unsecured senior debt;

• ranked effectively junior to our and the guarantor’s current and future secured senior indebtedness up

to the value of the collateral securing such indebtedness.

The indenture related to the 6 5/8% Senior Notes (the “6 5/8% Senior Notes Indenture”) contains restrictive

covenants that, among other things, impose limitations on the ability of EDBS and its restricted subsidiaries to:

• incur additional indebtedness or enter into sale and leaseback transactions;

• pay dividends or make distribution on EDBS’ capital stock or repurchase EDBS’ capital stock;

• make certain investments;

• create liens;

• enter into transactions with affiliates;

• merge or consolidate with another company; and

• transfer and sell assets.

In the event of a change of control, as defined in the related indenture, we will be required to make an offer to

repurchase all or any part of a holder’s 6 5/8% Senior Notes at a purchase price equal to 101% of the aggregate

principal amount thereof, together with accrued and unpaid interest thereon, to the date of repurchase.

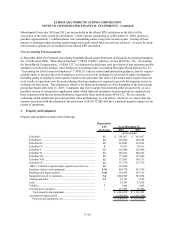

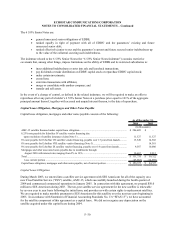

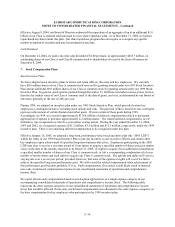

Capital Lease Obligation, Mortgages and Other Notes Payable

Capital lease obligation, mortgages and other notes payable consists of the following:

As of December 31,

2004 2003

(In thousands)

AMC-15 satellite financed under capital lease obligation......................................................................... 286,605$ -$

8.25% note payable for EchoStar IV satellite vendor financing due

upon resolution of satellite insurance claim (Note 3)............................................................................ 11,327 11,327

8% note payable for EchoStar VII satellite vendor financing, payable over 13 years from launch........... 13,549 14,302

8% note payable for EchoStar VIII satellite vendor financing (Note 3).................................................... - 14,381

8% note payable for EchoStar IX satellite vendor financing, payable over 14 years from launch............ 9,587 10,000

Mortgages and other unsecured notes payable due in installments through

August 2020 with interest rates ranging from 2% to 10% ................................................................... 10,667 9,312

Total ......................................................................................................................................................... $ 331,735 $ 59,322

Less current portion ............................................................................................................................. (45,062) (14,995)

Capital lease obligation, mortgages and other notes payable, net of current portion ............................... $ 286,673 $ 44,327

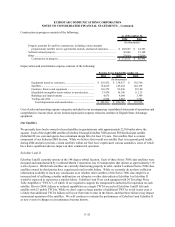

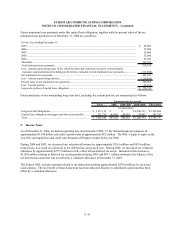

Capital Lease Obligation

During March 2003, we entered into a satellite service agreement with SES Americom for all of the capacity on a

new Fixed Satellite Service (“FSS”) satellite, AMC-15, which successfully launched during the fourth quarter of

2004 and commenced commercial operations in January 2005. In connection with this agreement, we prepaid $50.0

million to SES Americom during 2003. The ten-year satellite service agreement for the new satellite is renewable

by us on a year to year basis following the initial term, and provides us with certain rights to replacement satellites.

We are required to make monthly payments to SES Americom for this satellite over the next ten years beginning in

2005. In accordance with Statement of Financial Accounting Standards No. 13 (“SFAS 13”), we have accounted

for the satellite component of this agreement as a capital lease. We did not recognize any depreciation on the

satellite acquired under this capital lease during 2004.

F–30