Dish Network 2004 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2004 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – Continued

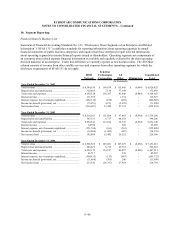

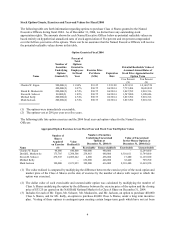

12. Quarterly Financial Data (Unaudited)

Our quarterly results of operations are summarized as follows:

For the Three Months Ended,

March 31 June 30 September 30 December 31

(In thousands, except per share data)

(Unaudited)

Year ended December 31, 2003:

Total revenue ............................................. 1,359,048$ 1,414,567$ 1,452,295$ 1,513,386$

Operating income (loss)............................... 178,748 222,993 160,485 145,322

Net income (loss)......................................... 57,917 128,793 35,116 2,680

Basic income per share ............................... 0.12$ 0.27$ 0.07$ 0.01$

Diluted income per share ............................ 0.12$ 0.26$ 0.07$ 0.01$

Year ended December 31, 2004:

Total revenue ............................................. 1,579,796$ 1,777,713$ 1,862,613$ 1,931,094$

Operating income (loss)............................... 122,166 184,017 194,924 202,198

Net income (loss)......................................... (42,886) 85,316 102,261 70,078

Basic income per share ............................... (0.09)$ 0.18$ 0.22$ 0.15$

Diluted income per share ............................ (0.09)$ 0.18$ 0.22$ 0.15$

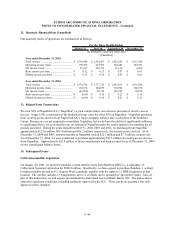

13. Related Party Transactions

We own 50% of NagraStar LLC (“NagraStar”), a joint venture that is our exclusive provider of security access

devices. Nagra USA, a subsidiary of the Kudelski Group, owns the other 50% of NagraStar. NagraStar purchases

these security access devices from NagraCard SA, a Swiss company which is also a subsidiary of the Kudelski

Group. Because we are not required to consolidate NagraStar, but we do have the ability to significantly influence

its operating policies, we accounted for our investment in NagraStar under the equity method of accounting for all

periods presented. During the years ended December 31, 2004, 2003 and 2002, we purchased from NagraStar

approximately $123.8 million, $68.4 million and $56.2 million, respectively, for security access devices. As of

December 31, 2004 and 2003, amounts payable to NagraStar totaled $22.7 million and $7.7 million, respectively.

As of December 31, 2004, we were committed to purchase approximately $92.5 million of security access devices

from NagraStar. Approximately $22.8 million of these commitments had been accrued for as of December 31, 2004

on our consolidated balance sheets.

14. Subsequent Events

Cablevision Satellite Acquisition

On January 20, 2005, we agreed to purchase certain satellite assets from Rainbow DBS Co., a subsidiary of

Cablevision Systems Corporation for $200.0 million. Specifically, we have agreed to purchase Rainbow 1, a direct

broadcast satellite located at 61.5 degrees West Longitude, together with the rights to 11 DBS frequencies at that

location. The satellite includes 13 transponders, up to 12 of which can be operated in "spot beam" mode. Also, as

part of this transaction, we will acquire ground facilities and related assets in Black Hawk, S.D. The transaction is

subject to customary conditions, including regulatory approval by the FCC. There can be no assurance that such

approval will be obtained.

F–48