Costco 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

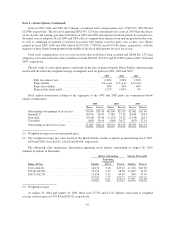

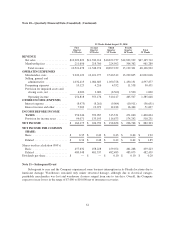

Note 7—Income Taxes (Continued)

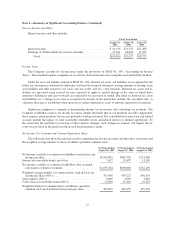

Reconciliation between the statutory tax rate and the effective rate for fiscal 2005, 2004 and 2003 is as fol-

lows:

2005 2004 2003

Federal taxes at statutory rate ................. $542,137 35.00% $490,218 35.00% $405,382 35.00%

State taxes, net ............................. 39,193 2.53 48,157 3.44 37,875 3.27

Foreign taxes, net .......................... (15,506) (1.00) (5,729) (0.41) (396) (0.03)

Transfer pricing settlement ................... (54,155) (3.50) — 0.00 — 0.00

Tax benefit on unremitted earnings ............. (30,602) (1.98) — 0.00 — 0.00

Translation gain on unremitted earnings ......... 10,010 0.65 — 0.00 — 0.00

Other .................................... (5,207) (0.33) (14,415) (1.03) (5,628) (0.49)

$485,870 31.37% $518,231 37.00% $437,233 37.75%

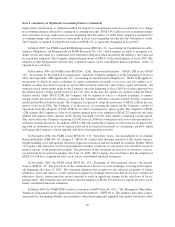

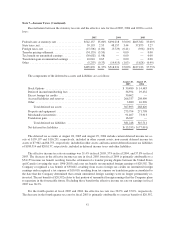

The components of the deferred tax assets and liabilities are as follows:

August 28,

2005

August 29,

2004

StockOptions .................................................... $ 30,480 $ 14,483

Deferred income/membership fees .................................... 36,594 29,432

Excess foreign tax credits ........................................... 30,602 —

Accrued liabilities and reserves ...................................... 266,337 208,409

Other ........................................................... 3,880 16,296

Total deferred tax assets ........................................ 367,893 268,620

Property and equipment ............................................ 273,794 271,798

Merchandise inventories ............................................ 91,407 73,913

Translation gain ................................................... 16,047 —

Total deferred tax liabilities ..................................... 381,248 345,711

Net deferred tax liabilities ........................................... $(13,355) $ (77,091)

The deferred tax accounts at August 28, 2005 and August 29, 2004 include current deferred income tax as-

sets of $159,197 and $116,291, respectively, included in other current assets; non-current deferred income tax

assets of $7,962 and $6,755, respectively, included in other assets; and non-current deferred income tax liabilities

of $180,514 and $200,137, respectively, included in deferred income taxes and other liabilities.

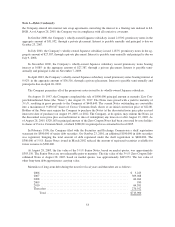

The effective income tax rate on earnings was 31.4% in fiscal 2005, 37% in fiscal 2004, and 37.8% in fiscal

2003. The decrease in the effective income tax rate in fiscal 2005 from fiscal 2004 is primarily attributable to a

$54,155 income tax benefit resulting from the settlement of a transfer pricing dispute between the United States

and Canada (covering the years 1996-2003) and a net tax benefit on unremitted foreign earnings of $20,592. The

Company recognized a tax benefit of $30,602, resulting from excess foreign tax credits on unremitted foreign

earnings and recognized a tax expense of $10,010, resulting from tax expense on translation gains accumulated to

the date that the Company determined that certain unremitted foreign earnings were no longer permanently re-

invested. The net benefit of $20,592 relates to that portion of unremitted foreign earnings that the Company plans

to repatriate in the foreseeable future. Excluding these benefits the effective income tax rate on earnings in fiscal

2005 was 36.2%.

For the fourth quarter of fiscal 2005 and 2004, the effective tax rate was 28.9% and 37.0%, respectively.

The decrease in the fourth quarter tax rate for fiscal 2005 is primarily attributable to a net tax benefit of $20,592,

57