Costco 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data) (Continued)

Note 3—Debt (Continued)

totaled approximately $131,169 and $166,800, respectively, including approximately $64,532 and $52,900, re-

spectively, in standby letters of credit.

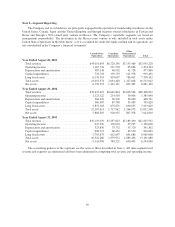

Short-Term Borrowings

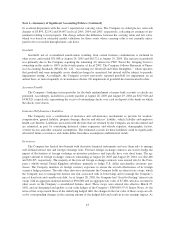

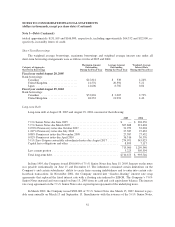

The weighted average borrowings, maximum borrowings and weighted average interest rate under all

short-term borrowing arrangements were as follows for fiscal 2005 and 2004:

Category of Aggregate

Short-term Borrowings

Maximum Amount

Outstanding

During the Fiscal Year

Average Amount

Outstanding

During the Fiscal Year

Weighted Average

Interest Rate

During the Fiscal Year

Fiscal year ended August 28, 2005

Bank borrowings:

Canadian .......................... $12,841 $ 338 4.24%

United Kingdom .................... 41,576 20,394 5.22

Japan ............................. 14,606 8,702 0.84

Fiscal year ended August 29, 2004

Bank borrowings:

Canadian .......................... $53,826 $ 3,005 2.73%

United Kingdom .................... 48,232 21,994 4.40

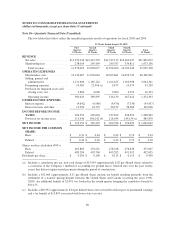

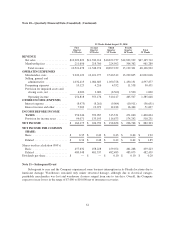

Long-term Debt

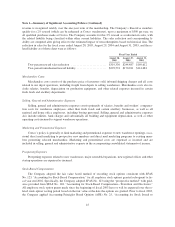

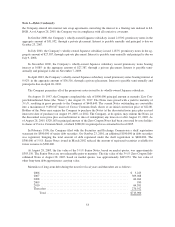

Long-term debt at August 28, 2005 and August 29, 2004 consisted of the following:

2005 2004

7

1

⁄

8

% Senior Notes due June 2005 .................................. $ — $ 304,350

5

1

⁄

2

% Senior Notes due March 2007 ................................. 307,688 321,404

2.070% Promissory notes due October 2007 ........................... 31,952 32,004

1.187% Promissory notes due July 2008 .............................. 27,387 27,432

0.88% Promissory notes due November 2009 .......................... 27,387 27,432

0.92% Promissory notes due April 2010 .............................. 36,516 36,576

3

1

⁄

2

% Zero Coupon convertible subordinated notes due August 2017 ....... 274,071 543,025

Capital lease obligations and other .................................. 8,899 7,117

713,900 1,299,340

Less current portion .............................................. 3,225 305,594

Total long-term debt .............................................. $710,675 $ 993,746

In June 1995, the Company issued $300,000 of 7

1

⁄

8

% Senior Notes due June 15, 2005. Interest on the notes

was payable semiannually on June 15 and December 15. The indentures contained certain limitations on the

Company’s and certain subsidiaries’ ability to create liens securing indebtedness and to enter into certain sale-

leaseback transactions. In November 2001, the Company entered into “fixed-to-floating” interest rate swap

agreements that replaced the fixed interest rate with a floating rate indexed to LIBOR. The Company’s 7

1

⁄

8

%

Senior Notes matured and were repaid on June 15, 2005 from its cash and cash equivalents balance. The interest

rate swap agreement on the 7

1

⁄

8

% Senior Notes also expired upon repayment of the underlying notes.

In March 2002, the Company issued $300,000 of 5

1

⁄

2

% Senior Notes due March 15, 2007. Interest is pay-

able semi-annually on March 15 and September 15. Simultaneous with the issuance of the 5

1

⁄

2

% Senior Notes,

52