Costco 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

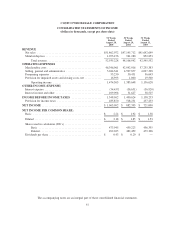

Note 1—Summary of Significant Accounting Policies (Continued)

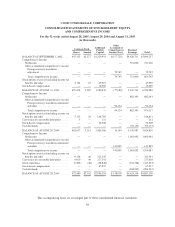

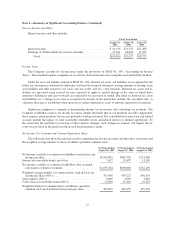

Short-term investments at August 28, 2005 and August 29, 2004, were as follows:

Fiscal 2005

Cost

Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Certificates of deposit ................................ $ 43,719 $ — $ — $ 43,719

U.S. government and agency securities ................... 562,370 25 (4,629) 557,766

Money market mutual funds ........................... 49,372 — — 49,372

Corporate notes and bonds ............................ 696,267 66 (2,289) 694,044

Asset and mortgage backed securities .................... 52,782 21 (432) 52,371

Total short-term investments ....................... $1,404,510 $112 $(7,350) $1,397,272

Fiscal 2004

Cost

Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Certificates of deposit ................................ $ 23,450 $ — $ — $ 23,450

U.S. government and agency securities ................... 46,060 102 (107) 46,055

Money market mutual funds ........................... 1,662 — — 1,662

Corporate notes and bonds ............................ 216,271 95 (149) 216,217

Asset and mortgage backed securities .................... 19,444 34 (115) 19,363

Total short-term investments ....................... $ 306,887 $231 $ (371) $ 306,747

Unrealized losses from fixed income securities are primarily attributable to changes in interest rates. Of the

unrealized losses of $7,350 and $371 at August 28, 2005 and August 29, 2004, respectively, $222 and $0 have

holding periods exceeding twelve months. Management does not believe any unrealized losses represent an

other-than-temporary impairment based on our evaluation of available evidence as of August 28, 2005. The

Company currently has the financial ability to hold short-term investments with an unrealized loss until maturity

and not incur any recognized losses.

The estimate of fair value is based on publicly available market information or other estimates determined

by management. The maturities of short-term investments at August 28, 2005, were as follows:

Cost Basis

Estimated

Fair Value

Due in one year or less .................................. $ 736,390 $ 735,075

Due after one year through five years ....................... 648,079 642,249

Due after five years ..................................... 20,041 19,948

Total ................................................ $1,404,510 $1,397,272

Short-term investments include fixed maturity securities.

Receivables, net

Receivables consist primarily of vendor rebates and promotional allowances, receivables from government

tax authorities and other miscellaneous amounts due to the Company, and are net of an allowance for doubtful

accounts of $1,416 at August 28, 2005 and $1,139 at August 29, 2004. Management determines the allowance for

doubtful accounts based on known troubled accounts and historical experience applied to an aging of accounts.

Vendor Rebates and Allowances

Periodic payments from vendors in the form of volume rebates or other purchase discounts that are evi-

denced by signed agreements are reflected in the carrying value of the inventory when earned or as the Company

41