Costco 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Certain statements contained in this document constitute forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. For these purposes, forward-looking statements are state-

ments that address activities, events, conditions or developments that the Company expects or anticipates may

occur in the future. Such forward-looking statements involve risks and uncertainties that may cause actual events,

results or performance to differ materially from those indicated by such statements. These risks and uncertainties

include, but are not limited to, domestic and international economic conditions including exchange rates, the ef-

fects of competition and regulation, consumer and small business spending patterns and debt levels, conditions

affecting the acquisition, development, ownership or use of real estate, actions of vendors, rising costs associated

with employees (including health care and workers’ compensation costs), rising costs associated with the acquis-

ition of merchandise (including the direct and indirect effects of the rising cost of petroleum-based products and

fuel and energy costs), geopolitical conditions and other risks identified from time to time in the Company’s pub-

lic statements and reports filed with the Securities and Exchange Commission.

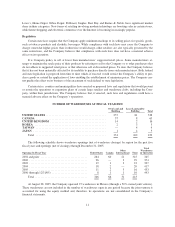

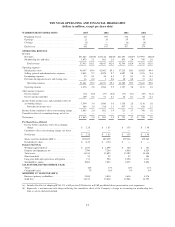

Executive Overview and Selected Consolidated Statements of Income Data

(dollars in thousands, except earnings per share)

Overview

Costco operates membership warehouses based on the concept that offering members very low prices on a

limited selection of nationally branded and selected private label products in a wide range of merchandise

categories will produce high sales volumes and rapid inventory turnover. This rapid inventory turnover, when

combined with the operating efficiencies achieved by volume purchasing, efficient distribution and reduced han-

dling of merchandise in no-frills, self-service warehouse facilities, enables Costco to operate profitably at sig-

nificantly lower gross margins than traditional wholesalers, discount retailers and supermarkets.

Key items for fiscal year 2005 included:

• Net sales increased 10% over the prior year, driven by an increase in comparable sales of 7% and the

opening of 16 new warehouses;

• Membership fees for fiscal 2005 increased 11.6% to $1,073,156, representing new member sign-ups at

new warehouses opened during the fiscal year, increasing penetration of the Company’s Executive

Membership program, and continued strong member renewal rates;

• Gross margin (net sales less merchandise costs) decreased nine basis points as a percent of net sales over

the prior year. Gross margins increased year-over-year in most of the Company’s merchandise catego-

ries, but were offset by changes in the sales mix with higher penetration of lower margin departments,

primarily gas. Additionally, margins were negatively impacted by ten basis points due to increased sales

penetration of the Executive Membership Program and its related costs;

• Selling, general and administrative expenses as a percentage of net sales improved two basis points over

the prior year, largely due to increased payroll leverage due to increased sales, a decrease in health care

costs as a percent of net sales and a flattening of the rising trend in workers’ compensation costs, offset

by higher stock option expense;

• Net income for fiscal 2005 increased 20.5% to $1,063,092, or $2.18 per diluted share. Net income dur-

ing fiscal 2005 was impacted by several non-recurring items that are discussed further in the comparison

of fiscal 2005 and fiscal 2004 below. Exclusive of these items, net income for fiscal 2005 would have

been $998,326 or $2.04 per diluted share, a 10% increase in earnings per share over the prior fiscal year.

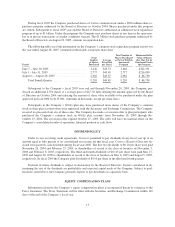

• The Board of Directors approved an increase in the quarterly cash dividend from $0.10 to $0.115 per

share; and

• During the fourth quarter of fiscal 2005 the Company repurchased shares of Costco common stock, expend-

ing approximately $413,252 repurchasing 9.2 million shares of stock at an average cost of $44.89 per share.

16