Costco 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interest Expense

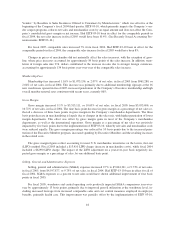

Interest expense totaled $36,651 in fiscal 2004, compared to $36,920 in fiscal 2003. Interest expense in both

fiscal 2004 and 2003 includes interest on the 3

1

⁄

2

% Zero Coupon Notes, 7

1

⁄

8

%and5

1

⁄

2

% Senior Notes and on

balances outstanding under the Company’s bank credit facilities and promissory notes. The decrease was primar-

ily a result of the Company’s reduction in short-term borrowings, principally related to its foreign subsidiaries.

This decrease was substantially offset by increases in interest rates on the Senior Notes due to interest rate swap

agreements converting the interest rate from fixed to floating.

Interest Income and Other

Interest income and other totaled $51,627 in fiscal 2004, compared to $38,525 in fiscal 2003. The increase

primarily reflects greater interest earned on higher cash and cash equivalents balances and short-term invest-

ments. In addition, a reduction in the expense to record minority interest in the earnings of foreign subsidiaries

was reported in fiscal 2004 as the Company increased its ownership in Costco Wholesale UK Limited to 100%.

Provision for Income Taxes

The effective income tax rate on earnings was 37% in fiscal 2004 and 37.75% in fiscal 2003. The decrease

in the effective income tax rate is primarily attributable to lower statutory income tax rates for foreign operations

and one-time benefits associated with certain tax planning strategies.

Liquidity and Capital Resources (dollars in thousands, except per share amounts)

Cash Flows

The Company’s primary sources of liquidity are cash flows generated from warehouse operations and our

existing cash and cash equivalents and short-term investments balances, which were $3,459,857 and $3,129,882

at August 28, 2005 and August 29, 2004, respectively. Net cash provided by operating activities totaled

$1,783,177 in fiscal 2005 compared to $2,098,783 in fiscal 2004, a decrease of $315,606. Higher net income and

a decrease in net merchandise inventories (merchandise inventory less accounts payable) year-over-year in-

creased cash flow from operating activities by $391,571. This increase was offset by decreases in cash flow from

operating assets and liabilities of $706,855, primarily relating to the timing in the collection of certain receivables

and in payments of income taxes in fiscal 2005 as compared to fiscal 2004.

A significant component of net cash used in investing activities continues to be the purchase of property and

equipment related to the Company’s warehouse expansion and remodel projects. Net cash used in investing activ-

ities totaled $2,058,729 in fiscal 2005 compared to $1,048,481 in fiscal 2004, an increase of $1,010,248. The in-

crease in investing activities primarily relates to an increase in the net investment in short-term investments of

$768,596 and an increase in additions to property and equipment of $289,811 in fiscal 2005 over fiscal 2004.

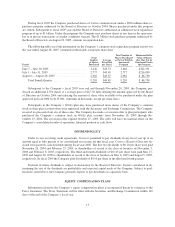

Net cash used in financing activities totaled $518,651 in fiscal 2005 compared to $209,569 provided by fi-

nancing activities in fiscal 2004. The decrease of $728,220 primarily resulted from an increase in the repayment

of debt of $297,275 primarily relating to the repayment of the 7

1

⁄

8

% Senior Notes, which matured on June 15,

2005, and repurchases of common stock of $413,252 under the Company’s $500,000 share repurchase program.

Dividends

Costco’s Board of Directors declared four quarterly cash dividends during fiscal year 2005. The first two

dividends of $0.10 per share were paid November 26, 2004 and February 25, 2005, to shareholders of record at

the close of business on November 5, 2004 and February 8, 2005, respectively. The third and fourth dividends of

22