Costco 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

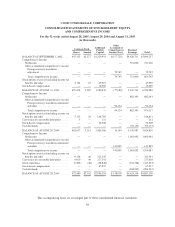

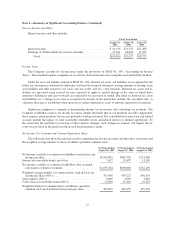

COSTCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME

For the 52 weeks ended August 28, 2005, August 29, 2004 and August 31, 2003

(in thousands)

Common Stock Additional

Paid-In

Capital

Other

Accumulated

Comprehensive

Income/(Loss)

Retained

Earnings TotalShares Amount

BALANCE AT SEPTEMBER 1, 2002 ..... 455,325 $2,277 $1,220,954 $(157,725) $4,628,731 $5,694,237

Comprehensive Income

Net Income ......................... — — — — 721,000 721,000

Other accumulated comprehensive income

Foreign currency translation

adjustment ....................... — — — 79,745 — 79,745

Total comprehensive income ......... — — — 79,745 721,000 800,745

Stock options exercised including income tax

benefits and other .................... 2,154 10 47,919 — — 47,929

Stock-based compensation ............... — — 12,069 — — 12,069

BALANCE AT AUGUST 31, 2003 ....... 457,479 2,287 1,280,942 (77,980) 5,349,731 6,554,980

Comprehensive Income

Net Income ......................... — — — — 882,393 882,393

Other accumulated comprehensive income

Foreign currency translation adjustment

and other ........................ — — — 94,124 — 94,124

Total comprehensive income ......... — — — 94,124 882,393 976,517

Stock options exercised including income tax

benefits and other .................... 5,153 26 148,785 — — 148,811

Conversion of convertible debentures ...... 5 — 131 — — 131

Stock-based compensation ............... — — 36,508 — — 36,508

Cash dividends ........................ — — — — (92,137) (92,137)

BALANCE AT AUGUST 29, 2004 ....... 462,637 2,313 1,466,366 16,144 6,139,987 7,624,810

Comprehensive Income

Net Income ......................... — — — — 1,063,092 1,063,092

Other accumulated comprehensive income

Foreign currency translation adjustment

and other ........................ — — — 141,895 — 141,895

Total comprehensive income ......... — — — 141,895 1,063,092 1,204,987

Stock options exercised including income tax

benefits and other .................... 9,138 46 323,545 — — 323,591

Conversion of convertible debentures ...... 9,910 49 277,554 — — 277,603

Stock repurchase ...................... (9,205) (46) (38,848) — (374,358) (413,252)

Stock-based compensation ............... — — 67,937 — — 67,937

Cash dividends ........................ — — — — (204,567) (204,567)

BALANCE AT AUGUST 28, 2005 ....... 472,480 $2,362 $2,096,554 $ 158,039 $6,624,154 $8,881,109

The accompanying notes are an integral part of these consolidated financial statements.

38