Costco 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 1—Summary of Significant Accounting Policies (Continued)

depreciation, amortization, or depletion method for long-lived, non-financial assets be accounted for as a change

in accounting estimate effected by a change in accounting principle. SFAS 154 is effective for accounting changes

and corrections of errors made in fiscal years beginning after December 15, 2005. Early adoption is permitted for

accounting changes and corrections of errors made in fiscal years beginning after the date this Statement is issued.

The Company is required to adopt the provisions of SFAS 154, as applicable, beginning in fiscal 2007.

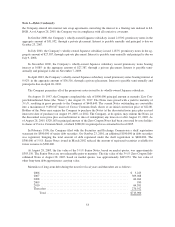

In March 2005, the FASB issued FASB Interpretation (FIN) No. 47, “Accounting for Conditional Asset Re-

tirement Obligations, An Interpretation of FASB Statement No. 143,” which requires an entity to recognize a li-

ability for the fair value of a conditional asset retirement obligation when incurred if the liability’s fair value can

be reasonably estimated. The Company adopted the provisions of FIN 47 in the fourth quarter of fiscal 2005. The

adoption of this Interpretation did not have a material impact on its consolidated financial position, results of

operations or cash flows.

In December 2004, the FASB issued SFAS No. 123R, “Share-based Payments”. SFAS 123R revises SFAS

123, “Accounting for Stock-Based Compensation,” which the Company adopted as of the beginning of its fiscal

2003, and supersedes APB Opinion No. 25, “Accounting for Stock Issued to Employees”. SFAS 123R applies to

transactions in which an entity exchanges its equity instruments for goods or services and also applies to li-

abilities an entity may incur for goods or services that are based on the fair value of those equity instruments. All

employee stock option grants made by the Company since the beginning of fiscal 2003 have been expensed over

the related option vesting period based on the fair value at the date the options are granted using the Black-

Scholes model. Under SFAS 123R, the Company will be required to select a valuation technique, or option-

pricing model that meets the criteria as stated in the standard. Allowable valuation models include a binomial

model and the Black-Scholes model. The Company is required to adopt the provisions of SFAS 123R in the first

quarter of its fiscal 2006. The Company is in the process of assessing the impact on the Company’s results of

operations from the adoption of FAS 123R for its effect on prospective option grants. The adoption of SFAS

123R requires the Company to value stock options granted prior to its adoption of SFAS 123 under the fair value

method and expense these amounts in the income statement over the stock option’s remaining vesting period.

This will result in the Company expensing $13,043 in fiscal 2006 that would previously have been presented in a

proforma footnote disclosure. In addition, SFAS 123R will require the Company to reflect the tax savings result-

ing from tax deductions in excess of expense reflected in its financial statements as a financing cash flow, which

will impact the Company’s future reported cash flows from operating activities.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs—An Amendment of Accounting

Research Bulletin (ARB) No. 43, Chapter 4”. SFAS 151 clarifies that abnormal amounts of idle facility expense,

freight, handling costs and spoilage should be expensed as incurred and not included in overhead. Further, SFAS

151 requires that allocation of fixed and production facilities overheads to conversion costs should be based on

normal capacity of the production facilities. The provisions in this statement are effective for inventory costs in-

curred during fiscal periods beginning after June 15, 2005. The Company does not believe that the adoption of

SFAS 151 will have a significant effect on its future consolidated financial statements.

In November 2004, the FASB issued SFAS No. 153, “Exchanges of Non-monetary Assets—An Amend-

ment of APB No. 29”. The provisions of this statement are effective for asset exchanges occurring in fiscal peri-

ods beginning after June 15, 2005. This statement eliminates the exception to fair value for exchanges of similar

productive assets and replaces it with a general exception for exchange transactions that do not have commercial

substance—that is, transactions that are not expected to result in significant changes in the cash flows of the re-

porting entity. The Company does not believe that the adoption of SFAS 153 will have a significant effect on its

future consolidated financial statements.

In March 2004, the FASB EITF reached a consensus on EITF Issue No. 03-1, “The Meaning of Other-Than-

Temporary Impairment and Its Application to Certain Investments,” (EITF 03-1). The guidance prescribes a three-

step model for determining whether an investment is other-than-temporarily impaired and requires disclosures about

49