Costco 2005 Annual Report Download - page 22

Download and view the complete annual report

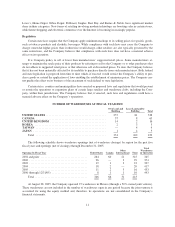

Please find page 22 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gross Margin

Gross margin increased 13.4% to $5,053,696, or 10.72% of net sales, in fiscal 2004 from $4,457,316, or

10.69% of net sales, in fiscal 2003. The three basis point increase, as a percent of net sales, reflected a 14 basis

point increase in gross margin in the Company’s merchandise departments, helped by strong year-over-year gross

margin gains in the Company’s ancillary business operations, particularly gasoline and pharmacy. Year-over-

year gross margin, as a percentage of net sales, was also positively impacted by the implementation of EITF

03-10, whereby net sales and merchandise costs were reduced, resulting in an eight basis point increase. The

year-over-year gross margin percentage was reduced by 12 basis points due to the increased rewards related to

the Executive Membership Two-Percent Reward Program, resulting from an increase in the penetration of the

Executive Member program.

The gross margin figures reflect accounting for most U.S. merchandise inventories on the LIFO method.

Fiscal 2004 included a $6,090 LIFO charge (increase in merchandise costs), while fiscal 2003 included a $19,650

LIFO credit (reduction in merchandise costs). The impact of the LIFO adjustment on a year-over-year basis neg-

atively impacted margin by an additional six basis points.

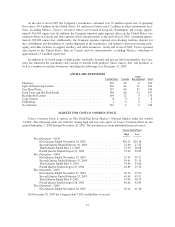

Selling, General and Administrative Expenses

Selling, general and administrative (SG&A) expenses as a percent of net sales decreased to 9.75% during

fiscal 2004 from 9.83% during fiscal 2003. Had EITF 03-10 been in effect in fiscal 2003, SG&A expenses as a

percent to net sales would have shown additional improvement of seven basis points in fiscal 2004.

For fiscal 2004, warehouse and central operating costs positively impacted SG&A comparisons year-over-

year by approximately 21 basis points, primarily due to increased expense leverage of warehouse payroll, bene-

fits (primarily health care), utility and workers’ compensation costs. During the latter half of fiscal 2004, the

Company implemented changes to its employee healthcare plans that reduced its overall healthcare costs, primar-

ily in the fourth quarter. This improvement was partially offset by the seven basis point increase resulting from

the adoption of EITF 03-10, a two basis point increase in expense related to the establishment of additional in-

surance liabilities resulting from financial difficulties being experienced by one of the Company’s third-party

insurance providers, and an increase in stock-based compensation costs following the Company’s prospective

adoption of Statement of Financial Accounting Standards (SFAS) No. 123, “Accounting for Stock Based

Compensation,” at the beginning of fiscal 2003, of four basis points.

Preopening Expenses

Preopening expenses totaled $30,451, or 0.07% of net sales, during fiscal 2004 compared to $36,643, or

0.09% of net sales, during fiscal 2003. This reduction was due to fewer warehouse openings. During fiscal 2004,

the Company opened 20 new warehouses compared to 29 new warehouses (including 5 relocations) during fiscal

2003. Pre-opening expenses also include costs related to remodels and expanded ancillary operations at existing

warehouses.

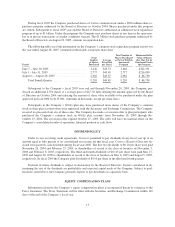

Provision for Impaired Assets and Closing Costs, net

The net provision for impaired assets and closing costs was $1,000 in fiscal 2004, compared to $19,500 in

fiscal 2003. The provision includes costs related to impairment of long-lived assets, future lease obligations of

warehouses that have been relocated to new facilities, and losses or gains resulting from the sale of real property.

The provision for fiscal 2004 included charges of $16,548 for warehouse closing expenses that were offset by

gains of $15,548 on the sale of real property. The provision for fiscal 2003 included charges of $11,836 for

warehouse closing expenses, $4,697 for impairment of long-lived assets and $2,967 for net losses on the sale of

real property. At August 29, 2004, the reserve for warehouse closing costs was $10,367, of which $9,184 related

to future lease obligations. This compares to a reserve for warehouse closing costs of $8,609 at August 31, 2003,

of which $7,833 related to future lease obligations.

21