Costco 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data) (Continued)

Note 1—Summary of Significant Accounting Policies (Continued)

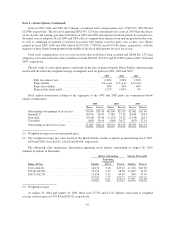

The diluted share base calculation for fiscal years ended August 28, 2005, August 29, 2004 and August 31,

2003, excludes 12,575,000, 24,748,000 and 33,362,000 stock options outstanding, respectively. These options are

excluded due to their anti-dilutive effect.

Dividends

Costco’s Board of Directors declared four quarterly cash dividends during fiscal year 2005. The first two

dividends of $0.10 per share were paid November 26, 2004 and February 25, 2005, to shareholders of record at

the close of business on November 5, 2004 and February 8, 2005, respectively. The remaining two dividends of

$0.115 per share were paid May 27, 2005 and August 26, 2005 to shareholders of record at the close of business

on May 6, 2005 and August 5, 2005, respectively. The Company paid a dividend of $0.10 per share in the third

and fourth quarters of fiscal 2004.

Payment of future dividends is subject to declaration by the Board of Directors. Factors considered in de-

termining the size of the dividends are profitability and expected capital needs of the Company. Subject to qual-

ifications stated above, the Company presently expects to pay dividends on a quarterly basis.

Stock Repurchase Program

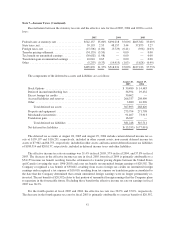

On November 30, 2001, the Company’s Board of Directors approved a stock repurchase program, authoriz-

ing the repurchase of up to $500,000 of Costco Common Stock through November 30, 2004. Under the program,

the Company could repurchase shares at any time in the open market or in private transactions as market con-

ditions warrant. The repurchased shares would be retired. On October 25, 2004, the Board of Directors renewed

the program for another three years. On June 7, 2005 the Company began repurchasing shares on the open mar-

ket and through August 28, 2005 the Company has repurchased 9,205,100 shares of common stock at an average

price of $44.89, totaling approximately $413,252, including commissions.

Subsequent to the Company’s fiscal 2005 year end, on August 29, 2005, the Board of Directors of Costco

authorized an additional stock repurchase program of up to $1,000,000. Under the program, which has no expira-

tion date, the Company may repurchase shares at any time in the open market or in private transactions as market

conditions warrant. Subsequent to the Company’s fiscal 2005 year end and through October 28, 2005, the Com-

pany purchased an additional 2,247,000 shares at an average price of $45.83, fully utilizing the amount approved

by the Board of Directors in October 2004 and reducing the amount of share value available to be purchased

under the plan approved in fiscal 2006 by $16,240.

Significant Non-Cash Transactions

During fiscal 2005, $280,811 in principal amount of the Company’s 3

1

⁄

2

% Zero Coupon Subordinated

Notes was converted by noteholders into 9,910,011 shares of common stock.

Recent Accounting Pronouncements

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections, A Replacement

of APB Opinion No. 20 and FASB Statement No. 3.” SFAS 154 requires retrospective application to prior peri-

ods’ financial statements for changes in accounting principles, unless it is impracticable to determine either the

period-specific effects or the cumulative effect of the change. SFAS 154 also requires that retrospective applica-

tion of a change in accounting principle be limited to the direct effects of the change. Indirect effects of a change

in accounting principle, such as a change in non-discretionary profit-sharing payments resulting from an account-

ing change, should be recognized in the period of the accounting change. SFAS 154 also requires that a change in

48