Costco 2005 Annual Report Download - page 21

Download and view the complete annual report

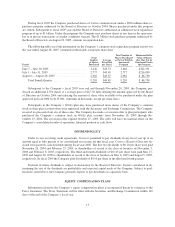

Please find page 21 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.settlement of a transfer pricing dispute between the United States and Canada (covering the years 1996-2003)

and a net tax benefit on excess foreign tax credits on unremitted foreign earnings of $20,592. Excluding these

benefits the effective income tax rate on earnings in fiscal 2005 was 36.2%.

For the fourth quarter of fiscal 2005 and 2004, the effective tax rate was 28.9% and 37.0%, respectively.

The decrease in the fourth quarter tax rate for fiscal 2005 is primarily attributable to the net tax benefit of

$20,592, noted above, and a tax benefit of $13,895 primarily associated with lower state taxes. The state tax

benefit recorded in the fourth quarter was primarily due to a reduction in the estimated effective state tax rate uti-

lized in the first through third quarters of fiscal 2005. Excluding the benefit of these two items, the fourth quarter

tax rate for fiscal 2005 would be 35.8%.

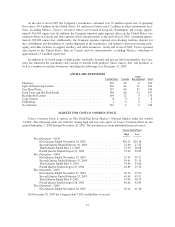

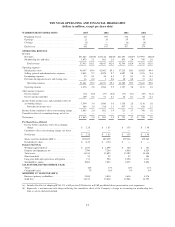

Comparison of Fiscal 2004 (52 weeks) and Fiscal 2003 (52 weeks):

(dollars in thousands, except earnings per share)

Net Income

Net income for fiscal 2004 increased 22.4% to $882,393, or $1.85 per diluted share, from $721,000, or

$1.53 per diluted share during fiscal year 2003.

Net Sales

Net sales increased 13.1% to $47,145,712 in fiscal 2004 from $41,692,699 in fiscal 2003. Approximately

78% of the increase was due to an increase in comparable warehouse sales, that is sales in warehouses open for at

least a year. The balance of the increase was due to opening 20 new warehouses during fiscal 2004 and a net of

23 new warehouses (29 opened, 6 closed) during fiscal 2003, a portion of which is not included in comparable

warehouse sales. Net sales were reduced by the implementation of Emerging Issues Task Force (EITF) Issue

No. 03-10, “Application of Issue No. 02-16, “Accounting by a Customer (Including a Reseller) for Certain Con-

sideration Received from a Vendor,” by Resellers to Sales Incentives Offered to Consumers by Manufacturers,”

which was effective at the beginning of the Company’s fiscal 2004 third quarter. EITF 03-10, which primarily

impacts the Company’s vendor coupon programs, reduces net sales and merchandise costs by an equal amount

and does not affect the Company’s consolidated gross margin or net income. Had EITF 03-10 been in effect for

the comparable periods in fiscal 2003, the net sales increase in fiscal 2004 would have been 13.8%. (See Re-

cently Issued Accounting Pronouncements, EITF 03-10.)

For fiscal 2004, comparable sales increased 10% from fiscal 2003. Had EITF 03-10 been in effect for the

comparable periods in fiscal 2003, the comparable sales increase for fiscal 2004 would have been 11%.

Changes in prices of merchandise did not materially affect the sales increases, with the exception of gaso-

line, where price increases accounted for a sales increase of approximately 70 basis points. In addition, due to the

weaker U.S. dollar throughout fiscal 2004 as compared to fiscal 2003, translation of foreign sales into U.S. dol-

lars contributed to the increase in sales, accounting for a comparable sales increase of approximately 190 basis

points year-over-year. Sales were also positively impacted by the supermarket strikes in Southern California dur-

ing the first half of the Company’s 2004 fiscal year. The positive impact to sales for the entire fiscal year was

estimated to be 35 to 50 basis points.

Membership Fees

Membership fees increased 12.7% to $961,280, or 2.04% of net sales, in fiscal 2004 from $852,853, or

2.05% of net sales, in fiscal 2003. This increase was primarily due to additional membership sign-ups at the 20

new warehouses opened in fiscal 2004; increased penetration of the Company’s Executive membership, includ-

ing the rollout of the program into Canada, which began in the first quarter of fiscal 2004; and high overall

member renewal rates consistent with recent years, currently at 86%.

20