Costco 2005 Annual Report Download - page 19

Download and view the complete annual report

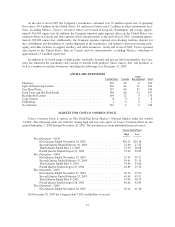

Please find page 19 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Vendor,” by Resellers to Sales Incentives Offered to Consumers by Manufacturers,” which was effective at the

beginning of the Company’s fiscal 2004 third quarter. EITF 03-10, which primarily impacts the Company’s ven-

dor coupon programs, reduces net sales and merchandise costs by an equal amount and does not affect the Com-

pany’s consolidated gross margin or net income. Had EITF 03-10 been in effect for the comparable periods in

fiscal 2004, the net sales increase in fiscal 2005 would have been 10.4%. (See Recently Issued Accounting Pro-

nouncements, EITF 03-10.)

For fiscal 2005, comparable sales increased 7% from fiscal 2004. Had EITF 03-10 been in effect for the

comparable periods in fiscal 2004, the comparable sales increase for fiscal 2005 would have been 8%.

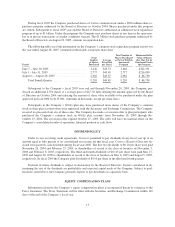

Changes in prices of merchandise did not materially affect the sales increases, with the exception of gaso-

line, where price increases accounted for approximately 89 basis points of the sales increase. In addition, trans-

lation of foreign sales into U.S. dollars contributed to the increase in sales due to stronger foreign currencies,

accounting for approximately 134 basis points year-over-year of the comparable sales increase.

Membership Fees

Membership fees increased 11.6% to $1,073,156, or 2.07% of net sales, in fiscal 2005 from $961,280, or

2.04% of net sales, in fiscal 2004. This increase was primarily due to additional membership sign-ups at the 16

new warehouses opened in fiscal 2005, increased penetration of the Company’s Executive membership and high

overall member renewal rates consistent with recent years, currently 86%.

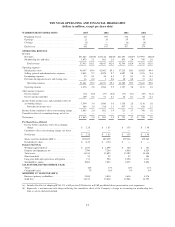

Gross Margin

Gross margin increased 9.1% to $5,515,111, or 10.63% of net sales, in fiscal 2005 from $5,053,696, or

10.72% of net sales, in fiscal 2004. The nine basis point decrease in gross margin as a percentage of net sales re-

flected a decrease of three basis points in gross margin in the Company’s merchandise departments. The three

basis point decrease in merchandising is largely due to changes in the sales mix, with higher penetration of lower

margin departments. This effect was offset by gross margin gains in most of the Company’s merchandise

departments, as well as the international operations. Gross margin as a percentage of net sales was positively

impacted by five basis points due to the implementation of EITF 03-10, whereby net sales and merchandise costs

were reduced equally. The gross margin percentage was reduced by 10 basis points due to the increased pene-

tration of the Executive Member program, increased spending by Executive Members and the resulting increases

in the related costs.

The gross margin figures reflect accounting for most U.S. merchandise inventories on the last-in, first-out

(LIFO) method. Fiscal 2005 included a $13,410 LIFO charge (increase in merchandise costs), while fiscal 2004

included a $6,090 LIFO charge. The impact of the LIFO adjustment on a year-over-year basis negatively im-

pacted gross margin, as a percentage of sales, by one additional basis point.

Selling, General and Administrative Expenses

Selling, general and administrative (SG&A) expenses increased 9.7% to $5,044,341, or 9.73% of net sales,

in fiscal 2005, from $4,597,877, or 9.75% of net sales, in fiscal 2004. Had EITF 03-10 been in effect for all of

fiscal 2004, SG&A expenses as a percent to net sales would have shown additional improvement of four basis

points in fiscal 2005.

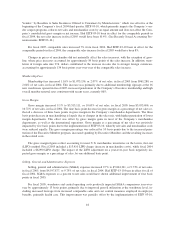

For fiscal 2005, warehouse and central operating costs positively impacted SG&A comparisons year-over-

year by approximately 13 basis points, primarily due to improved payroll utilization at the warehouse level, in-

cluding increased leverage from increased comparable sales and cost control measures employed in employee

benefits, primarily health care. This improvement was partially offset by the implementation of EITF 03-10,

18