Costco 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data) (Continued)

Note 1—Summary of Significant Accounting Policies (Continued)

unrealized losses on investments. The accounting guidance became effective for reporting periods beginning after

June 15, 2004, while the disclosure requirements became effective for annual reporting periods ending after

June 15, 2004. In September 2004, the FASB issued FASB Staff Position (FSP) EITF 03-1-1, “Effective Date of

Paragraphs 10-20 of EITF Issue No. 03-1 ‘The Meaning of Other-Than-Temporary Impairment and Its Application

to Certain Investments,” (FSP EITF 03-1-1). FSP EITF 03-1-1 delayed the effective date for the measurement and

recognition guidance contained in paragraphs 10-20 of EITF Issue 03-1. In November 2005, the FASB issued FSP

FAS 115-1 and FAS 124-1, “The Meaning of Other-Than-Temporary Impairment and its Application to Certain

Investments.” This FSP addresses the determination as to when an investment is considered impaired, whether the

impairment is other than temporary and the measurement of an impairment loss. This statement specifically nullifies

the requirements of paragraph 10-18 of EITF 03-1 and references existing other-than-temporary impairment guid-

ance. The guidance under this FSP is effective for reporting periods beginning after December 15, 2005 and the

Company continued to apply relevant “other-than-temporary” guidance as provided for in FSP EITF 03-1-1 during

fiscal 2005. The Company does not believe that the adoption of the guidance of FSP FAS 115-1 and FAS 124-1 will

have a significant effect on its future consolidated financial statements.

In November 2003, the EITF reached consensus on Issue No. 03-10, “Application of Issue No. 02-16 by

Resellers to Sales Incentives Offered to Consumers by Manufacturers,” with respect to determining if consid-

eration received by a reseller from a vendor that is reimbursed by the vendor for honoring the vendor’s sale in-

centives offered directly to consumers should be recorded as a reduction in sales. These rules apply to

transactions entered into by consumers in fiscal periods beginning after November 25, 2003 and, therefore, apply

to such transactions starting with the Company’s fiscal third quarter of 2004, which began February 16, 2004.

The adoption of EITF 03-10 did not affect the Company’s consolidated gross profit or net income, but did result

in a reduction of both net sales and merchandise costs by an equal amount. Had the Company’s first half of fiscal

2004 and all of fiscal 2003 been reported under EITF 03-10 guidance, the sales and cost of sales would have been

reduced by approximately $186,900 and $282,300, respectively.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States requires management to make estimates and assumptions that affect the reported amounts of assets

and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from those

estimates.

Reclassifications

Certain reclassifications have been made to prior fiscal years to conform to the presentation adopted in the

current fiscal year.

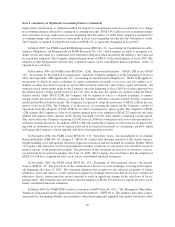

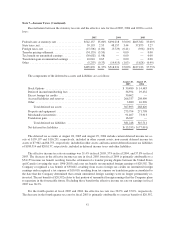

Note 2—Comprehensive Income

Comprehensive income is net income, plus certain other items that are recorded directly to stockholders’

equity. Comprehensive income was $1,204,987 for fiscal 2005, $976,517 for fiscal 2004 and $800,745 for fiscal

2003. Foreign currency translation adjustments and unrealized gains and losses on short-term investments are the

primary components applied to net income to calculate the Company’s comprehensive income and totaled

$146,273 and ($4,378), respectively, for fiscal 2005, $94,264 and ($140), respectively, for fiscal 2004, and

$79,745 and $0, respectively, for fiscal 2003.

50