Costco 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

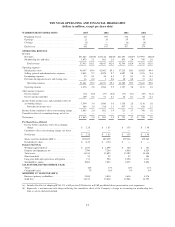

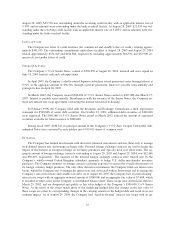

SELECTED CONSOLIDATED STATEMENTS OF INCOME DATA

The table below presents selected operational data, the percentage relationship between net sales and

major categories in the Consolidated Statements of Income and the percentage change in the dollar amounts

of each of the items.

Percent of Net Sales

Percentage Increase/(Decrease)

(of dollar amounts)

Fiscal 2005 Fiscal 2004 Fiscal 2003

Fiscal 2005

vs. Fiscal 2004

Fiscal 2004

vs. Fiscal 2003

Net sales ............................... 100.00% 100.00% 100.00% 10.0% 13.1%

Membership fees ........................ 2.07 2.04 2.05 11.6 12.7

Grossmargin(a) ......................... 10.63 10.72 10.69 9.1 13.4

Selling, general and administrative expenses . . . 9.73 9.75 9.83 9.7 12.2

Preopeningexpenses ..................... 0.10 0.07 0.09 74.8 (16.9)

Provision for impaired assets and closing costs,

net .................................. 0.03 — 0.05 1539.3 (94.9)

Operating income .................... 2.84 2.94 2.77 6.4 19.8

Interest expense ......................... (0.06) (0.08) (0.08) (6.0) (0.7)

Interest income and other .................. 0.21 0.11 0.09 111.3 34.0

Incomebeforeincometaxes............ 2.99 2.97 2.78 10.6 20.9

Provision for income taxes ............. 0.94 1.10 1.05 (6.2) 18.5

NetIncome ..................... 2.05% 1.87% 1.73% 20.5% 22.4%

(a) Defined as net sales less merchandise costs.

Comparison of Fiscal 2005 (52 weeks) and Fiscal 2004 (52 weeks):

(dollars in thousands, except earnings per share)

Net Income

Net income for fiscal 2005 increased 20.5% to $1,063,092, or $2.18 per diluted share, from $882,393, or

$1.85 per diluted share, during fiscal year 2004. Net income during fiscal 2005 was impacted by the following: a

$54,155 (approximately $.11 per diluted share) income tax benefit resulting primarily from the settlement of a

transfer pricing dispute between the United States and Canada (covering the years 1996-2003); a cumulative

pre-tax, non-cash charge to preopening expenses of $15,999 (approximately $.02 per diluted share) related to a

correction to the Company’s method of accounting for ground leases (entered into over the past twenty years)

that did not require rental payments during the period of construction; and a net tax benefit with respect to excess

foreign tax credits on unremitted foreign earnings recorded in the fourth quarter of $20,592 (approximately $.04

per diluted share). Exclusive of these items, net income for fiscal 2005 would have been $998,326 or $2.04 per

diluted share, a 10% increase in earnings per share over the prior fiscal year.

Net Sales

Net sales increased 10.0% to $51,862,072 in fiscal 2005 from $47,145,712 in fiscal 2004. Approximately

71% of the increase was due to an increase in comparable warehouse sales, that is sales in warehouses open for at

least a year. The balance of the increase was due to opening 16 new warehouses during fiscal 2005 and 20 new

warehouses during fiscal 2004, a portion of which is not included in comparable warehouse sales. Net sales were

reduced by the implementation of Emerging Issues Task Force (EITF) Issue No. 03-10, “Application of Issue

No. 02-16, “Accounting by a Customer (Including a Reseller) for Certain Consideration Received from a

17