Costco 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COSTCO WHOLESALE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(dollars in thousands, except per share data)

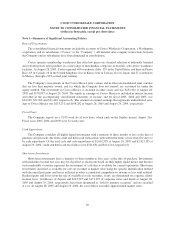

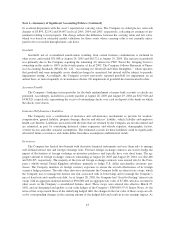

Note 1—Summary of Significant Accounting Policies

Basis of Presentation

The consolidated financial statements include the accounts of Costco Wholesale Corporation, a Washington

corporation, and its subsidiaries (“Costco” or the “Company”). All material inter-company transactions between

the Company and its subsidiaries have been eliminated in consolidation.

Costco operates membership warehouses that offer low prices on a limited selection of nationally branded

and selected private label products in a wide range of merchandise categories in no-frills, self-service warehouse

facilities. At August 28, 2005, Costco operated 460 warehouse clubs: 335 in the United States and three in Puerto

Rico; 65 in Canada; 16 in the United Kingdom; five in Korea; four in Taiwan; five in Japan; and 27 warehouses

in Mexico (through a 50%-owned joint venture).

The Company’s investments in the Costco Mexico joint venture and in other unconsolidated joint ventures

that are less than majority owned, and for which the Company does not control, are accounted for under the

equity method. The investment in Costco Mexico is included in other assets and was $232,402 at August 28,

2005 and $178,997 at August 29, 2004. The equity in earnings of Costco Mexico is included in interest income

and other in the accompanying consolidated statements of income, and for fiscal 2005, 2004 and 2003, was

$24,949, $22,208 and $21,400, respectively. The amount of retained earnings that represents undistributed earn-

ings of Costco Mexico was $133,231 and $108,282 at August 28, 2005 and August 29, 2004, respectively.

Fiscal Years

The Company reports on a 52/53-week fiscal year basis, which ends on the Sunday nearest August 31st.

Fiscal years 2005, 2004 and 2003 were 52-week years.

Cash Equivalents

The Company considers all highly liquid investments with a maturity of three months or less at the date of

purchase and proceeds due from credit and debit card transactions with settlement terms of less than five days to

be cash equivalents. Of the total cash and cash equivalents of $2,062,585 at August 28, 2005 and $2,823,135 at

August 29, 2004, credit and debit card receivables were $521,634 and $441,244, respectively.

Short-term Investments

Short-term investments have a maturity of three months to five years at the date of purchase. Investments

with maturities beyond one year may be classified as short-term based on their highly liquid nature and because

such marketable securities represent the investment of cash that is available for current operations. Short-term

investments classified as available for sale are recorded at market value using the specific identification method

with the unrealized gains and losses reflected in other accumulated comprehensive income or loss until realized.

Realized gains and losses from the sale of available for sale securities, if any, are determined on a specific identi-

fication basis. Certificates of deposit and $215,525 and $171,179 of corporate notes and bonds at August 28,

2005 and August 29, 2004, respectively, have been designated as “hold to maturity securities” and are recorded

at cost. At August 28, 2005 and August 29, 2004, the cost of these securities approximated market value.

40