Costco 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

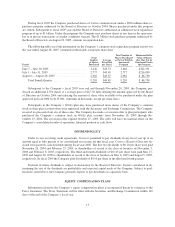

During fiscal 2005 the Company purchased shares of Costco common stock under a $500 million share re-

purchase program authorized by the Board of Directors in October 2004. Shares purchased under this program

are retired. Subsequent to fiscal 2005 year-end the Board of Directors authorized an additional stock repurchase

program of up to $1 billion. Under the programs the Company may purchase shares at any time in the open mar-

ket or in private transactions as market conditions warrant. The $1 billion stock purchase program authorized by

the Board of Directors on August 29, 2005, contains no expiration date.

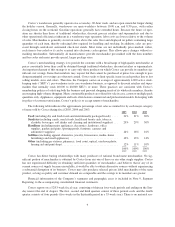

The following table sets forth information on the Company’s common stock repurchase program activity for

the year ended August 28, 2005. (Amounts in thousands, except per share data):

Period

Total

Number

of Shares

Purchased

Average

Price Paid

per Share

Total Number of

Shares Purchased

as Part of Publicly

Announced

Program

Maximum Dollar

Value of Shares

that May Yet be

Purchased Under

the Program

June 7 – June 30, 2005 .......................... 3,446 $45.73 3,446 $342,391

July 1 – July 31, 2005 .......................... 2,777 $45.49 2,777 $216,090

August 1 – August 28, 2005 ..................... 2,982 $43.37 2,982 $ 86,750

Total Fourth Quarter ....................... 9,205 $44.89 9,205 $ 86,750

Subsequent to the Company’s fiscal 2005 year end and through November 20, 2005, the Company pur-

chased an additional 4,352 shares at a average price of $47.50, fully utilizing the amount approved by the Board

of Directors in October 2004 and reducing the amount of share value available to be purchased under the plan

approved in fiscal 2006 by $119,960. (Amounts in thousands, except per share data.)

Participants in the Company’s 401(k) plan may have purchased more shares of the Company’s common

stock in their plan accounts than were registered with the Securities and Exchange Commission. The Company

received no proceeds from any of these sales. The Company has made a rescission offer to plan participants who

purchased the Company’s common stock in 401(k) plan accounts from November 16, 2003 through No-

vember 15, 2004. The rescission offer expired October 27, 2005. The offer will have no material effect on the

Company’s consolidated results of operations, financial position or cash flows.

DIVIDEND POLICY

Under its two revolving credit agreements, Costco is permitted to pay dividends in any fiscal year up to an

amount equal to fifty percent of its consolidated net income for that fiscal year. Costco’s Board of Directors de-

clared four quarterly cash dividends during fiscal year 2005. The first two dividends of $0.10 per share were paid

November 26, 2004 and February 25, 2005, to shareholders of record at the close of business on November 5,

2004 and February 8, 2005, respectively. The third and fourth dividends of $0.115 per share were paid May 27,

2005 and August 26, 2005 to shareholders of record at the close of business on May 6, 2005 and August 5, 2005,

respectively. In fiscal 2004 the Company paid dividends of $0.10 per share in the third and fourth quarters.

Payment of future dividends is subject to declaration by the Board of Directors. Factors considered in de-

termining the size of the dividends are profitability and expected capital needs of the Company. Subject to qual-

ifications stated above, the Company presently expects to pay dividends on a quarterly basis.

EQUITY COMPENSATION PLANS

Information related to the Company’s equity compensation plans is incorporated herein by reference to the

Proxy Statement. The Proxy Statement will be filed with the Securities and Exchange Commission within 120

days of the end of the Company’s fiscal year.

13