Costco 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

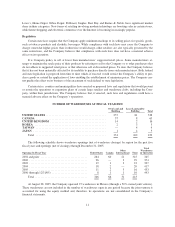

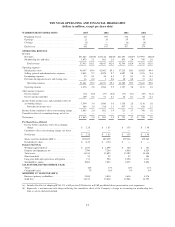

TEN YEAR OPERATING AND FINANCIAL HIGHLIGHTS

(dollars in millions, except per share data)

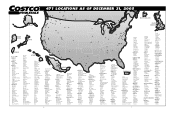

WAREHOUSES IN OPERATIONS 2005 2004 2003 2002

Beginningofyear ............................ 417 397 374 345

Openings ................................... 21 20 29 35

Closings.................................... (5) — (6) (6)

Endofyear ................................. 433 417 397 374

OPERATING RESULTS

Revenue

Net Sales ..................................... $51,862 100.0% $47,146 100.0% $41,693 100.0% $37,993 100.0%

Membership fees and other ....................... 1,073 2.1 961 2.0 853 2.0 769 2.0

Totalrevenue ............................... 52,935 102.1 48,107 102.0 42,546 102.0 38,762 102.0

Operating expenses

Merchandise costs .............................. 46,347 89.4 42,092 89.3 37,235 89.3 33,983 89.4

Selling, general and administrative expenses ......... 5,045 9.7 4,598 9.7 4,097 9.8 3,576 9.4

Preopeningexpenses............................ 53 0.1 30 0.1 37 0.1 51 0.1

Provision for impaired assets and closing costs ....... 16 0.0 1 0.0 20 0.0 21 0.1

Operating expenses ........................... 51,461 99.2 46,721 99.1 41,389 99.2 37,631 99.0

Operating income .............................. 1,474 2.8 1,386 2.9 1,157 2.8 1,131 3.0

Other income (expense)

Interest expense ................................ (34) (0.0) (37) (0.0) (37) (0.1) (29) (0.1)

Interest income and other ........................ 109 0.2 51 0.1 38 0.1 36 0.1

Income before income taxes and cumulative effect of

accountingchange.............................. 1,549 3.0 1,400 3.0 1,158 2.8 1,138 3.0

Provision for income taxes ..................... 486 1.0 518 1.1 437 1.1 438 1.2

Income before cumulative effect of accounting change . . . 1,063 2.0 882 1.9 721 1.7 700 1.8

Cumulative effect of accounting change, net of tax ...... — — — — — — — —

Netincome ..................................... $ 1,063 2.0 $ 882 1.9 $ 721 1.7 $ 700 1.8

Per Share Data—Diluted

Income before cumulative effect of accounting

change ................................... $ 2.18 $ 1.85 $ 1.53 $ 1.48

Cumulative effect of accounting change, net of tax . . — — — —

NetIncome ................................. $ 2.18 $ 1.85 $ 1.53 $ 1.48

Shares used in calculation (000’s) ............... 492,035 485,459 479,326 479,262

Dividendspershare........................... $ 0.43 $ 0.20 $ — $ —

Balance Sheet Data

Working capital (deficit) ....................... $ 1,477 $ 1,099 $ 700 $ 181

Property and equipment, net .................... 7,790 7,264 6,960 6,524

Total assets ................................. 16,514 15,093 13,192 11,620

Short-term debt .............................. 54 22 47 104

Long-term debt and capital lease obligations ....... 711 994 1,290 1,211

Stockholders’ equity .......................... 8,881 7,625 6,555 5,694

SALES INCREASE FROM PRIOR YEAR

Total ...................................... 10% 13% 10% 11%

Comparable units ............................ 7% 10% 5% 6%

MEMBERS AT YEAR END (000’S)

Business (primary cardholders) ................. 5,050 4,810 4,636 4,476

GoldStar ................................... 16,233 15,018 14,984 14,597

(a) Includes the effect of adopting SFAS 121, a $65 pre-tax ($39 after-tax or $0.09 pre diluted share) provision for asset impairment.

(b) Represents a one-time non-cash charge reflecting the cumulative effect of the Company’s change in accounting for membership fees

from a cash to a deferred method.

14