Columbia Sportswear 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

70

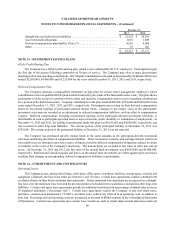

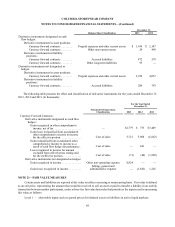

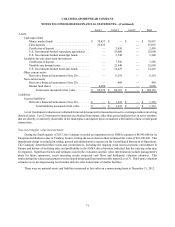

Level 2 – inputs, other than the quoted market prices in active markets, that are observable, either directly or

indirectly; or observable market prices in markets with insufficient volume and/or infrequent transactions;

and

Level 3 – unobservable inputs for which there is little or no market data available, that require the reporting entity

to develop its own assumptions.

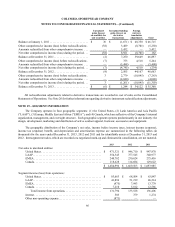

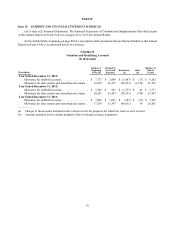

Assets and liabilities measured at fair value on a recurring basis as of December 31, 2013 are as follows (in thousands):

Level 1 Level 2 Level 3 Total

Assets:

Cash equivalents

Money market funds . . . . . . . . . . . . . . . . . . . . . . . . . $ 175,624 $ — $ — $ 175,624

Time deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,111 9,526 — 34,637

Certificates of deposit . . . . . . . . . . . . . . . . . . . . . . . . — 735 — 735

Reverse repurchase agreements . . . . . . . . . . . . . . . . — 45,000 — 45,000

U.S. Government-backed municipal bonds . . . . . . . — 9,898 — 9,898

Available-for-sale short-term investments

Short-term municipal bond fund. . . . . . . . . . . . . . . . 15,004 — — 15,004

Certificates of deposit . . . . . . . . . . . . . . . . . . . . . . . . — 9,546 — 9,546

Variable-rate demand notes. . . . . . . . . . . . . . . . . . . . — 52,105 — 52,105

U.S. Government-backed municipal bonds . . . . . . . — 14,764 — 14,764

Other short-term investments

Mutual fund shares 336 — — 336

Other current assets

Derivative financial instruments (Note 20). . . . . . . . — 4,892 — 4,892

Non-current assets

Derivative financial instruments (Note 20). . . . . . . . — 24 — 24

Mutual fund shares . . . . . . . . . . . . . . . . . . . . . . . . . . 4,855 — — 4,855

Total assets measured at fair value . . . . . . . . . $ 220,930 $ 146,490 $ — $ 367,420

Liabilities:

Accrued liabilities

Derivative financial instruments (Note 20). . . . . . . . $ — $ 1,152 $ — $ 1,152

Other long-term liabilities

Derivative financial instruments (Note 20) — 95 — 95

Total liabilities measured at fair value. . . . . . . $ — $ 1,247 $ — $ 1,247

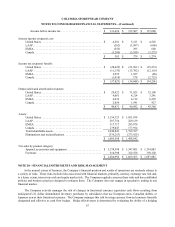

Assets and liabilities measured at fair value on a recurring basis at December 31, 2012 are as follows (in thousands):