Columbia Sportswear 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

56

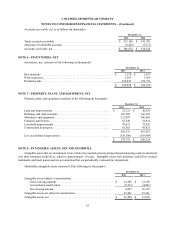

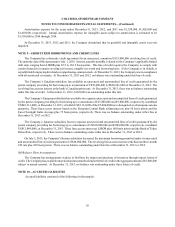

Amortization expense for the years ended December 31, 2013, 2012, and 2011 was $1,330,000, $1,402,000 and

$1,403,000, respectively. Annual amortization expense for intangible assets subject to amortization is estimated to be

$1,330,000 in 2014 through 2018.

At December 31, 2013, 2012 and 2011, the Company determined that its goodwill and intangible assets were not

impaired.

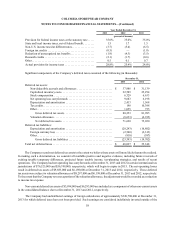

NOTE 9—SHORT-TERM BORROWINGS AND CREDIT LINES

The Company has a domestic credit agreement for an unsecured, committed $125,000,000 revolving line of credit.

The maturity date of this agreement is July 1, 2018. Interest, payable monthly, is based on the Company’s applicable funded

debt ratio, ranging from LIBOR plus 87.5 to 162.5 basis points. This line of credit requires the Company to comply with

certain financial covenants covering net income, tangible net worth and borrowing basis. If the Company is in default, it

is prohibited from paying dividends or repurchasing common stock. At December 31, 2013, the Company was in compliance

with all associated covenants. At December 31, 2013 and 2012, no balance was outstanding under this line of credit.

The Company’s Canadian subsidiary has available an unsecured and uncommitted line of credit guaranteed by the

parent company providing for borrowing up to a maximum of C$30,000,000 (US$28,241,000) at December 31, 2013. The

revolving line accrues interest at the bank’s Canadian prime rate. At December 31, 2013, there was no balance outstanding

under this line of credit. At December 31, 2012, $156,000 was outstanding under this line.

The Company’s European subsidiary has available two separate unsecured and uncommitted lines of credit guaranteed

by the parent company providing for borrowing up to a maximum of €25,800,000 and €5,000,000, respectively (combined

US$42,331,000), at December 31, 2013, of which US$3,161,000 of the €5,000,000 line is designated as a European customs

guarantee. These lines accrue interest based on the European Central Bank refinancing rate plus 50 basis points and the

Euro Overnight Index Average plus 75 basis points, respectively. There was no balance outstanding under either line at

December 31, 2013 or 2012.

The Company’s Japanese subsidiary has two separate unsecured and uncommitted lines of credit guaranteed by the

parent company providing for borrowing up to a maximum of US$10,000,000 and ¥300,000,000, respectively (combined

US$12,849,000), at December 31, 2013. These lines accrue interest at LIBOR plus 100 basis points and the Bank of Tokyo

Prime Rate, respectively. There was no balance outstanding under either line at December 31, 2013 or 2012.

On July 5, 2013, the Company’s Korean subsidiary decreased the maximum borrowing permitted under its unsecured

and uncommitted line of credit agreement to US$20,000,000. The revolving line accrues interest at the Korean three-month

CD rate plus 220 basis points. There was no balance outstanding under this line at December 31, 2013 or 2012.

Off-Balance Sheet Arrangements

The Company has arrangements in place to facilitate the import and purchase of inventory through import letters of

credit. The Company has available unsecured and uncommitted import letters of credit in the aggregate amount of $5,000,000

subject to annual renewal. At December 31, 2013, no balance was outstanding under these letters of credit.

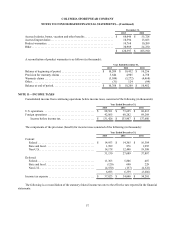

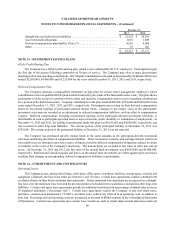

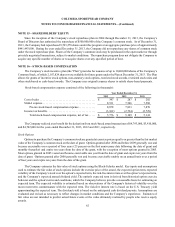

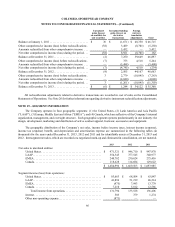

NOTE 10—ACCRUED LIABILITIES

Accrued liabilities consisted of the following (in thousands):