Columbia Sportswear 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

49

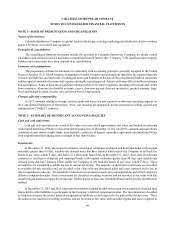

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

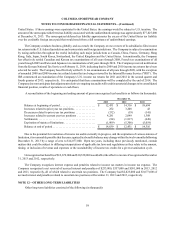

NOTE 1—BASIS OF PRESENTATION AND ORGANIZATION

Nature of the business:

Columbia Sportswear Company is a global leader in the design, sourcing, marketing and distribution of active outdoor

apparel, footwear, accessories and equipment.

Principles of consolidation:

The consolidated financial statements include the accounts of Columbia Sportswear Company, its wholly owned

subsidiaries and entities in which it maintains a controlling financial interest (the “Company”). All significant intercompany

balances and transactions have been eliminated in consolidation.

Estimates and assumptions:

The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America (U.S. GAAP) requires management to make estimates and assumptions that affect the reported amounts

of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements

and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from these estimates

and assumptions. Some of these more significant estimates relate to revenue recognition, including sales returns and claims

from customers, allowance for doubtful accounts, excess, slow-moving and close-out inventories, product warranty, long-

lived and intangible assets, income taxes and stock-based compensation.

Changes affecting comparability:

In 2013, amounts relating to foreign currency gains and losses are now reported as other non-operating expense on

the Consolidated Statements of Operations. Prior year amounts are immaterial and are presented in selling, general and

administrative ("SG&A") expenses.

NOTE 2—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

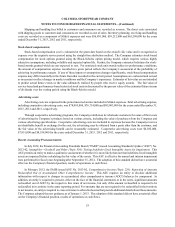

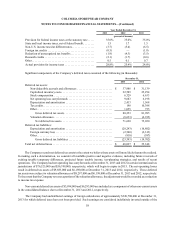

Cash and cash equivalents:

Cash and cash equivalents are stated at fair value or at cost, which approximates fair value, and include investments

with original maturities of 90 days or less at the date of acquisition. At December 31, 2013 and 2012, cash and cash equivalents

consisted of cash, money market funds, time deposits, certificates of deposit, repurchase agreements and municipal bonds

with original maturities ranging from overnight to less than 90 days.

Investments:

At December 31, 2013, short-term investments consisted of certificates of deposit and municipal bonds with original

maturities greater than 90 days, variable-rate demand notes that have features which enable the Company to sell back the

bonds at par value within 7 days and shares in a short-term bond fund. At December 31, 2012, short-term investments

consisted of certificates of deposit and municipal bonds with original maturities greater than 90 days and variable-rate

demand notes that have features which enable the Company to sell back the bonds at par value within 7 days. These

investments are considered available for use in current operations. The majority of short-term investments are classified

as available-for-sale securities and are recorded at fair value with any unrealized gains and losses reported, net of tax, in

other comprehensive income. The remainder of short-term investments consists of investments held as part of the Company's

deferred compensation plan. These investments are classified as trading securities and are recorded at fair value with any

unrealized gain and losses reported in net income. Realized gains or losses are determined based on the specific identification

method.

At December 31, 2013 and 2012, long-term investments included in other non-current assets consisted of mutual fund

shares held to offset liabilities to participants in the Company’s deferred compensation plan. The investments are classified

as long-term because the related deferred compensation liabilities are not expected to be paid within the next year. These

investments are classified as trading securities and are recorded at fair value with unrealized gains and losses reported in