Columbia Sportswear 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

69

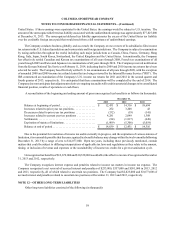

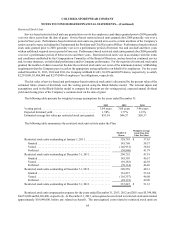

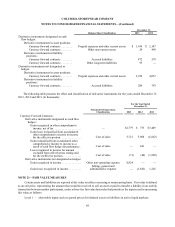

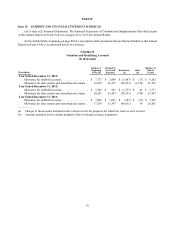

December 31,

Balance Sheet Classification 2013 2012

Derivative instruments designated as cash

flow hedges:

Derivative instruments in asset positions:

Currency forward contracts . . . . . . . . Prepaid expenses and other current assets $ 1,936 $ 2,147

Currency forward contracts . . . . . . . . Other non-current assets 24 489

Derivative instruments in liability

positions:

Currency forward contracts . . . . . . . . Accrued liabilities 872 579

Currency forward contracts . . . . . . . . Other long-term liabilities 95 —

Derivative instruments not designated as

hedges:

Derivative instruments in asset positions:

Currency forward contracts . . . . . . . . Prepaid expenses and other current assets 2,956 4,072

Derivative instruments in liability

positions:

Currency forward contracts . . . . . . . . Accrued liabilities 280 743

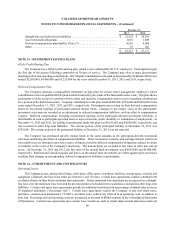

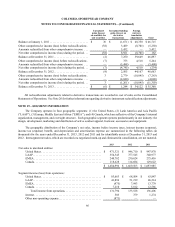

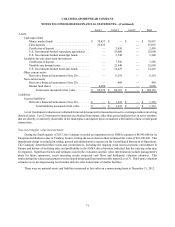

The following table presents the effect and classification of derivative instruments for the years ended December 31,

2013, 2012 and 2011 (in thousands):

For the Year Ended

December 31,

Statement Of Operations

Classification 2013 2012 2011

Currency Forward Contracts:

Derivative instruments designated as cash flow

hedges:

Gain recognized in other comprehensive

income, net of tax . . . . . . . . . . . . . . . . . . . — $2,779 $ 753 $3,489

Gain (loss) reclassified from accumulated

other comprehensive income to income

for the effective portion. . . . . . . . . . . . . . . Cost of sales 5,721 5,908 (6,862)

Gain reclassified from accumulated other

comprehensive income to income as a

result of cash flow hedge discontinuance . Cost of sales — 441 —

Loss recognized in income for amount

excluded from effectiveness testing and

for the ineffective portion . . . . . . . . . . . . . Cost of sales (71)(40)(1,889)

Derivative instruments not designated as hedges:

Gain recognized in income . . . . . . . . . . . . . . Other non-operating expense 8,824 — —

Gain (loss) recognized in income . . . . . . . . . Selling, general and

administrative expense —(1,841) 1,216

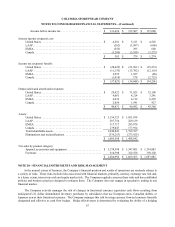

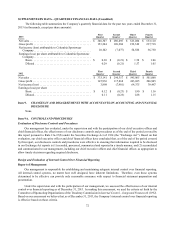

NOTE 21—FAIR VALUE MEASURES

Certain assets and liabilities are reported at fair value on either a recurring or nonrecurring basis. Fair value is defined

as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants, under a three-tier fair value hierarchy that prioritizes the inputs used in measuring

fair value as follows:

Level 1 – observable inputs such as quoted prices for identical assets or liabilities in active liquid markets;