Columbia Sportswear 2013 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Columbia Sportswear Company enhanced

its product and marketing strategies during

2013, driving renewed sales growth in three

of our four geographic regions and two of

our three major brands, and setting the

stage for more robust sales and earnings

growth in 2014.

Although global net sales rose only 1 percent during 2013, the year

concluded with strong sales momentum, as increased consumer

demand across our U.S. direct-to-consumer platform expanded

into U.S. wholesale channels, leading to 6 percent global sales

growth in the fourth quarter.

For the full year, U.S. and Canadian sales each grew 3 percent on

the strength of our direct-to-consumer platform, which more than

offset lower wholesale sales resulting from cautious advance orders

by wholesale customers in the wake of two consecutive warm

winters. Sales in the EMEA (Europe/Middle East/Africa) region grew

4 percent, refl ecting increased sales to independent distributors in

the region, which offset lower sales in our Europe-direct wholesale

markets. LAAP (Latin America/Asia Paci c) region sales declined 6

percent due to a combination of import restrictions and currency

constraints in key South American markets, and the translation

effects of a weaker Japanese yen, which offset growth in our Korean

business.

Net income of $94.3 million, or $2.72 per diluted share, in 2013

declined 6 percent from 2012 net income of $99.9 million, or $2.93

per diluted share, primarily due to a non-cash asset impairment

charge of $5.6 million after tax, or $0.16 per diluted share, related

to our European distribution center. Without that charge, 2013 net

income would have been essentially equal to 2012.

The company generated a record $274.3 million in cash fl ow

from operations in 2013, fueled in part by a 9 percent reduction

in consolidated inventory levels and lower wholesale accounts

receivable. Inventories across our North American wholesale

channels were also generally leaner exiting 2013, clearing the way

for customers to place advance orders for broader assortments of

our Fall 2014 styles, especially in the Columbia and Sorel brands.

We enter 2014 with renewed momentum in key wholesale markets

and a balance sheet that is stronger than ever, with more than $529

million in cash and investments and no long-term debt.That strong

nancial position and con dence in our long-term growth prospects

prompted the board of directors to authorize a 12 percent increase

in the quarterly dividend to 28 cents per share, following directly on

the heels of a 14 percent increase in late 2013.

Columbia Sportswear is, rst and foremost, a product- and

marketing-driven company. Our rst priority is to get the products

right – solving consumers’ problems with sensible innovations that

are differentiated from competitors’ and packaged in great design

at affordable prices.

Dear Fellow Shareholders:

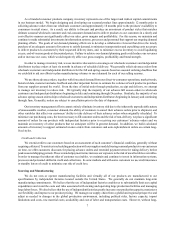

The Columbia brand strives to keep consumers warm, dry, cool and

protected in the outdoors year-around. We solidi ed Columbia’s

existing portfolio of innovations and expanded it with the launch

of TurboDown™, a patent-pending combination of natural down

and synthetic insulation that also features our iconic Omni-Heat™

Refl ective warmth technology. With more accessible price points

across the entire line, we expect the Columbia brand to post double-

digit growth in 2014 after growing 2 percent in 2013.

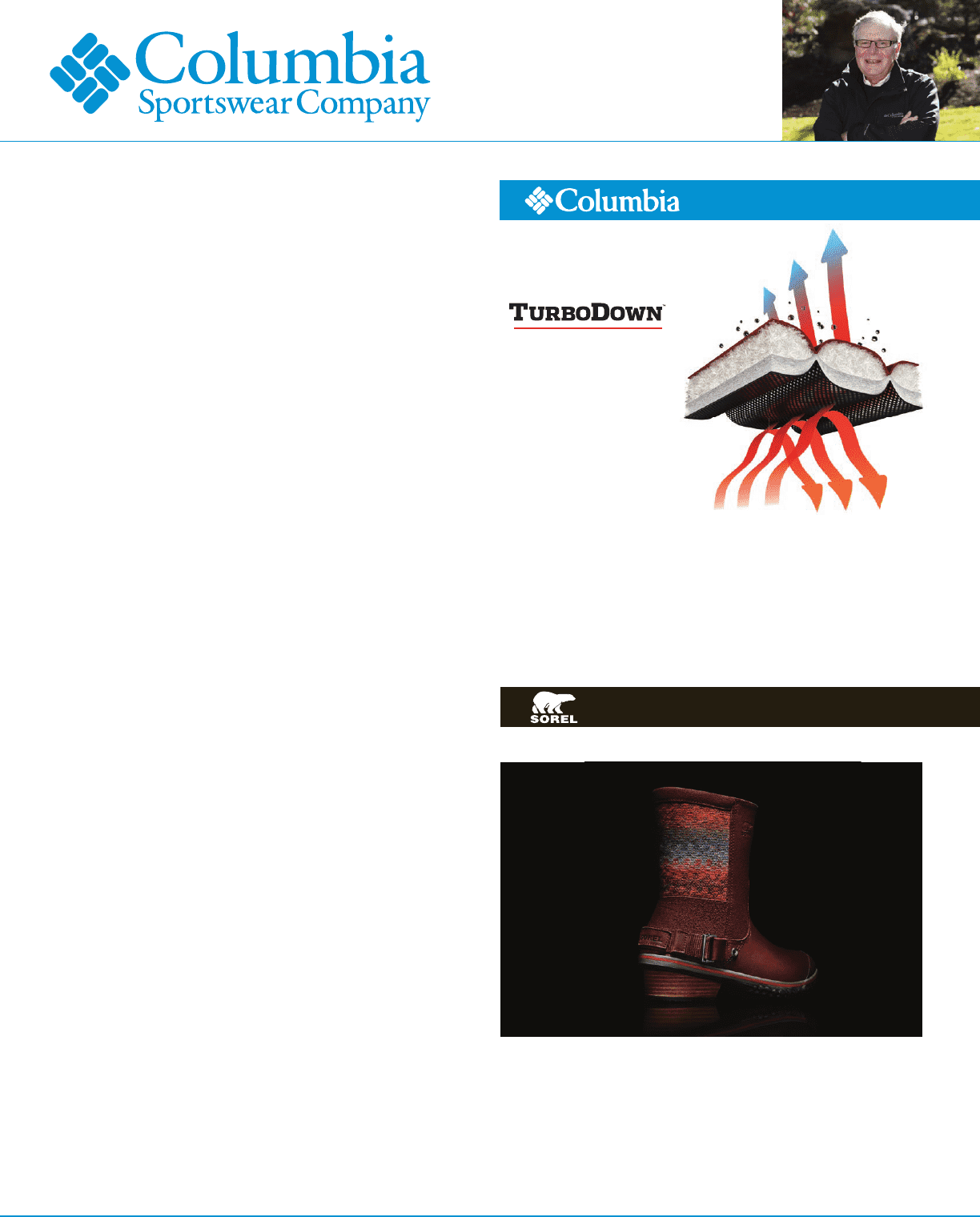

The SOREL brand is focused on fueling increased awareness and

adoption among young, fashion-forward women who are looking

for footwear that offers stylish protection and comfort from early fall

through late winter. SOREL’s expanded assortment of lightweight,

less-insulated styles is gaining penetration in leading footwear retailers

and extending the brand’s budding relationship with a new generation

of consumers. After growing just 1 percent in 2013, we expect

double-digit growth from SOREL in 2014.

PERFORMANCE

ENHANCED DOWN