Columbia Sportswear 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

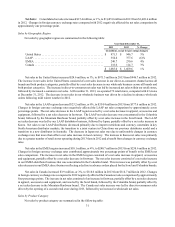

Year Ended December 31,

2012 2011 % Change

(In millions, except for percentage changes)

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 946.7 $ 948.0 —%

LAAP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 377.6 341.0 11%

EMEA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 230.6 275.4 (16)%

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 114.7 129.6 (11)%

$ 1,669.6 $ 1,694.0 (1)%

Net sales in the United States decreased $1.3 million, or less than 1%, to $946.7 million in 2012 from $948.0 million

in 2011. The decrease in net sales in the United States consisted of a net sales decrease in our wholesale business across

all brands and both product categories, partially offset by a net sales increase in our direct-to-consumer channel across all

brands and both product categories. The decrease in net sales in our wholesale business was driven by unseasonably warm

winter weather and general consumer caution, resulting in higher cancellations of advance orders and fewer reorders from

wholesale customers. The increase in direct-to-consumer net sales was due to a greater number of retail stores operating

during 2012 than 2011 and, to a lesser degree, increased sales from existing stores. At December 31, 2012, we operated 63

retail stores, compared with 51 at December 31, 2011.

Net sales in the LAAP region increased $36.6 million, or 11%, to $377.6 million in 2012 from $341.0 million in 2011.

Changes in foreign currency exchange rates affected the LAAP net sales comparison by less than one percent. The net sales

increase in the LAAP region was led by a net sales increase in apparel, accessories and equipment, followed by a net sales

increase in footwear. The LAAP net sales increase was concentrated in the Columbia brand, followed by the Mountain

Hardwear brand and the Sorel brand. The LAAP net sales increase was led by Japan, followed by Korea and our LAAP

distributor business. The increase in Japan net sales was led by an increase in wholesale net sales, followed by an increase

in direct-to-consumer net sales. The increase in Korea net sales was primarily due to a greater number of retail stores

operating during 2012 than in 2011, partially offset by the negative effect of foreign currency exchange rates. Net sales to

our LAAP distributors increased due to higher demand in key distributor markets, partially offset by a smaller percentage

of spring 2013 advance orders shipping in the fourth quarter of 2012 compared to shipments of spring 2012 advance orders

in the fourth quarter of 2011.

Net sales in the EMEA region decreased $44.8 million, or 16%, to $230.6 million in 2012 from $275.4 million in

2011. Changes in foreign currency exchange rates negatively affected the EMEA net sales comparison by approximately

four percentage points. The decrease in net sales in our EMEA region was led by footwear, followed by apparel, accessories

and equipment. The net sales decrease consisted of a net sales decrease in our EMEA direct business reflecting a decline

in advance orders due to the effects of the unseasonably warm 2011/2012 winter and a challenging macroeconomic

environment, which have hampered our ongoing efforts to revitalize the Columbia brand in key European markets. This

decrease was partially offset by a net sales increase in the EMEA distributor business, partially due to higher demand in

Russia.

Net sales in Canada decreased $14.9 million, or 11%, to $114.7 million in 2012 from $129.6 million in 2011. Changes

in foreign currency exchange rates compared to 2011 affected the Canada net sales comparison by less than one percent.

The decrease in net sales was led by apparel, accessories and equipment, followed by footwear, and was led by the Columbia

brand, followed by the Sorel and Mountain Hardwear brands. The Canada net sales decrease was primarily a result of a

decline in fall 2012 advance orders for Columbia brand products due to the unseasonably warm 2011/2012 winter and

retailer consolidation in the region.

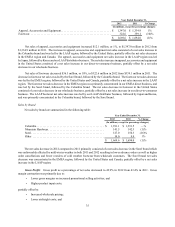

Sales by Product Category

Net sales by product category are summarized in the following table: