Columbia Sportswear 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

67

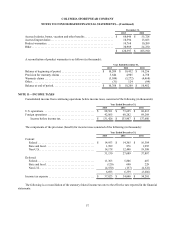

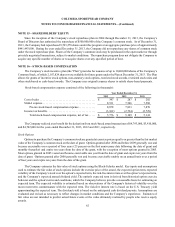

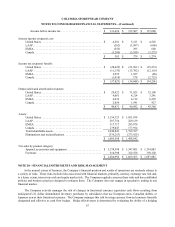

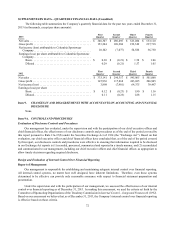

Income before income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 131,426 $ 133,907 $ 137,680

Interest income (expense), net:

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,501 $ 5,121 $ 4,565

LAAP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (162) (1,097) (666)

EMEA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (556) 293 648

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,280) (3,938) (3,273)

$ 503 $ 379 $ 1,274

Income tax (expense) benefit:

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (28,629) $ (21,961) $ (19,233)

LAAP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11,135) (13,792) (12,163)

EMEA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,959 1,527 (80)

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,018) 178 (2,725)

$(37,823) $ (34,048) $ (34,201)

Depreciation and amortization expense:

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 29,922 $ 31,025 $ 33,100

LAAP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,061 4,214 3,241

EMEA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,032 4,112 6,292

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,856 1,541 927

$ 40,871 $ 40,892 $ 43,560

Assets:

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,156,323 $ 1,031,838

LAAP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 287,754 229,139

EMEA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 317,717 293,878

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 179,047 177,912

Total identifiable assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,940,841 1,732,767

Eliminations and reclassifications. . . . . . . . . . . . . . . . . . . . . . . . . . (335,253) (273,925)

$ 1,605,588 $ 1,458,842

Net sales by product category:

Apparel, accessories and equipment . . . . . . . . . . . . . . . . . . . . . . . . $ 1,374,598 $ 1,347,005 $ 1,334,883

Footwear . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 310,398 322,558 359,102

$ 1,684,996 $ 1,669,563 $ 1,693,985

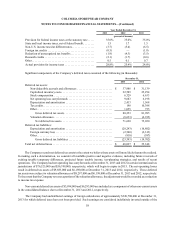

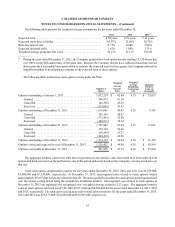

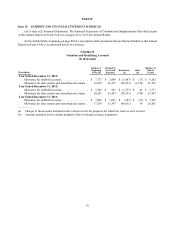

NOTE 20—FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

In the normal course of business, the Company’s financial position and results of operations are routinely subject to

a variety of risks. These risks include risks associated with financial markets, primarily currency exchange rate risk and,

to a lesser extent, interest rate risk and equity market risk. The Company regularly assesses these risks and has established

policies and business practices designed to mitigate them. The Company does not engage in speculative trading in any

financial market.

The Company actively manages the risk of changes in functional currency equivalent cash flows resulting from

anticipated U.S. dollar denominated inventory purchases by subsidiaries that use European euros, Canadian dollars, or

Japanese yen as their functional currency. The Company manages this risk by using currency forward contracts formally

designated and effective as cash flow hedges. Hedge effectiveness is determined by evaluating the ability of a hedging