Columbia Sportswear 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

57

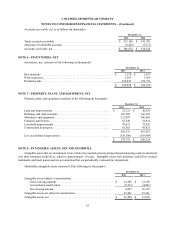

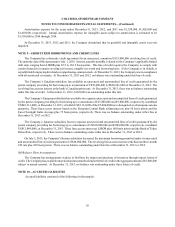

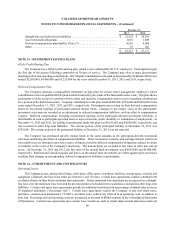

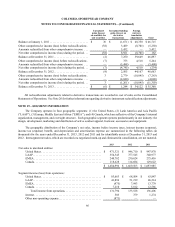

December 31,

2013 2012

Accrued salaries, bonus, vacation and other benefits . . . . . . . . . . . . . . . . . . . . $ 68,046 $ 55,728

Accrued import duties. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,594 15,023

Product warranties. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,768 10,209

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,989 24,230

$ 120,397 $ 105,190

A reconciliation of product warranties is as follows (in thousands):

Year Ended December 31,

2013 2012 2011

Balance at beginning of period. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,209 $ 10,452 $ 10,256

Provision for warranty claims . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,644 4,905 4,758

Warranty claims . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,054) (5,272) (4,468)

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (31) 124 (94)

Balance at end of period. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10,768 $ 10,209 $ 10,452

NOTE 11—INCOME TAXES

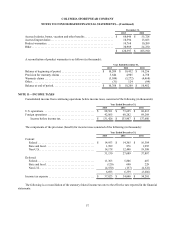

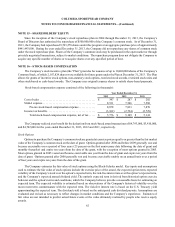

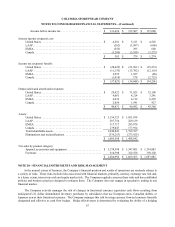

Consolidated income from continuing operations before income taxes consisted of the following (in thousands):

Year Ended December 31,

2013 2012 2011

U.S. operations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 88,561 $ 73,625 $ 68,412

Foreign operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,865 60,282 69,268

Income before income tax. . . . . . . . . . . . . . . . . . . . . . . . $ 131,426 $ 133,907 $ 137,680

The components of the provision (benefit) for income taxes consisted of the following (in thousands):

Year Ended December 31,

2013 2012 2011

Current:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14,953 $ 14,365 $ 16,384

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,999 876 1,995

Non-U.S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,178 12,448 19,508

31,130 27,689 37,887

Deferred:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,363 5,806 407

State and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (120) 690 229

Non-U.S. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,550) (137) (4,322)

6,693 6,359 (3,686)

Income tax expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 37,823 $ 34,048 $ 34,201

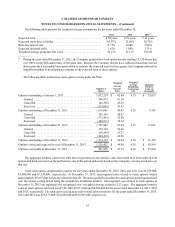

The following is a reconciliation of the statutory federal income tax rate to the effective rate reported in the financial

statements: