Columbia Sportswear 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

66

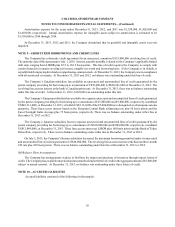

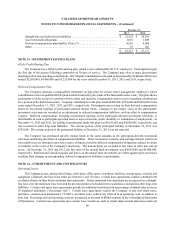

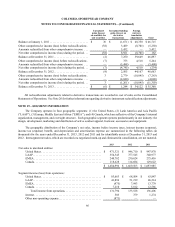

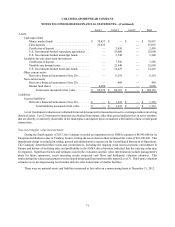

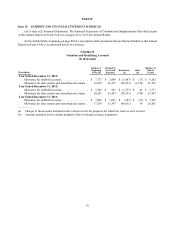

Unrealized

gains (losses)

on available for

sale securities

Unrealized holding

gains (losses) on

derivative

transactions

Foreign

currency

translation

adjustments Total

Balance at January 1, 2011. . . . . . . . . . . . . . . . . . . . . . . . . . . $ 36 $ (1,671) $ 48,350 $ 46,715

Other comprehensive income (loss) before reclassifications . (38) 3,489 (8,701) (5,250)

Amounts reclassified from other comprehensive income . . . — 5,432 — 5,432

Net other comprehensive income (loss) during the period. . . (38) 8,921 (8,701) 182

Balance at December 31, 2011. . . . . . . . . . . . . . . . . . . . . . . . (2) 7,250 39,649 46,897

Other comprehensive income (loss) before reclassifications . (7) 753 4,518 5,264

Amounts reclassified from other comprehensive income . . . — (5,498) — (5,498)

Net other comprehensive income (loss) during the period. . . (7) (4,745) 4,518 (234)

Balance at December 31, 2012. . . . . . . . . . . . . . . . . . . . . . . . (9) 2,505 44,167 46,663

Other comprehensive income (loss) before reclassifications . 3 2,779 (10,045) (7,263)

Amounts reclassified from other comprehensive income . . . — (4,040) — (4,040)

Net other comprehensive income (loss) during the period. . . 3 (1,261) (10,045) (11,303)

Balance at December 31, 2013. . . . . . . . . . . . . . . . . . . . . . . . $(6) $ 1,244 $ 34,122 $ 35,360

All reclassification adjustments related to derivative transactions are recorded in cost of sales on the Consolidated

Statements of Operations. See Note 20 for further information regarding derivative instrument reclassification adjustments.

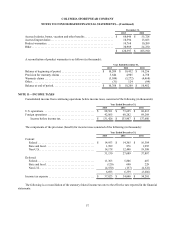

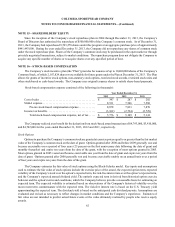

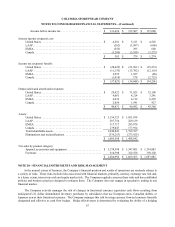

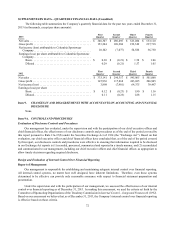

NOTE 19—SEGMENT INFORMATION

The Company operates in four geographic segments: (1) the United States, (2) Latin America and Asia Pacific

(“LAAP”), (3) Europe, Middle East and Africa (“EMEA”), and (4) Canada, which are reflective of the Company’s internal

organization, management, and oversight structure. Each geographic segment operates predominantly in one industry: the

design, development, marketing and distribution of active outdoor apparel, footwear, accessories and equipment.

The geographic distribution of the Company’s net sales, income before income taxes, interest income (expense),

income tax (expense) benefit, and depreciation and amortization expense are summarized in the following tables (in

thousands) for the years ended December 31, 2013, 2012 and 2011 and for identifiable assets at December 31, 2013 and

2012. Intersegment net sales, which are recorded at a negotiated mark-up and eliminated in consolidation, are not material.

2013 2012 2011

Net sales to unrelated entities:

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 971,321 $ 946,710 $ 947,970

LAAP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 354,345 377,545 340,977

EMEA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 240,702 230,624 275,416

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 118,628 114,684 129,622

$ 1,684,996 $ 1,669,563 $ 1,693,985

Segment income (loss) from operations:

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 83,663 $ 68,504 $ 63,847

LAAP. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41,896 51,219 46,214

EMEA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (975) 7,993 13,779

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,210 5,812 12,566

Total income from operations. . . . . . . . . . . . . . . . . . . . . . . . . . 131,794 133,528 136,406

Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 503 379 1,274

Other non-operating expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (871) — —