Columbia Sportswear 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

54

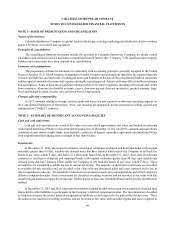

In March 2013, the FASB issued ASU No. 2013-05, Foreign Currency Matters (Topic 830): Parent's Accounting for

the Cumulative Translation Adjustment upon Derecognition of Certain Subsidiaries or Groups of Assets within a Foreign

Entity or of an Investment in a Foreign Entity. This ASU provides clarification regarding the release of any cumulative

translation adjustment when the parent ceases to have controlling financial interest in a business or group of assets held

within a foreign entity. The amendment is effective on a prospective basis for interim and annual periods beginning after

December 15, 2013. The Company does not expect the adoption of this standard to have a material effect on the Company's

financial position, results of operations or cash flows.

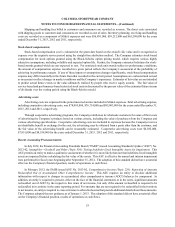

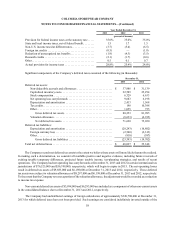

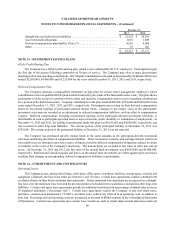

NOTE 3—CONCENTRATIONS

Trade Receivables

The Company had one customer in its Canada segment that accounted for approximately 10.5% of consolidated

accounts receivable at December 31, 2013. No single customer accounted for 10% or more of consolidated accounts

receivable at December 31, 2012. No single customer accounted for 10% or more of consolidated revenues for any of the

years ended December 31, 2013, 2012 or 2011.

Derivatives

The Company uses derivative instruments to hedge the currency exchange rate risk of anticipated transactions

denominated in non-functional currencies that are designated and qualify as cash flow hedges. The Company also uses

derivative instruments to economically hedge the currency exchange rate risk of certain investment positions, to hedge

balance sheet re-measurement risk and to hedge other anticipated transactions that do not qualify as cash flow hedges. At

December 31, 2013, the Company’s derivative contracts had a remaining maturity of approximately two years or less. The

maximum net exposure to any single counterparty, which is generally limited to the aggregate unrealized gain of all contracts

with that counterparty, was less than $2,000,000 at December 31, 2013. All of the Company’s derivative counterparties

have investment grade credit ratings and as a result, the Company does not require collateral to facilitate transactions. See

Note 20 for further disclosures concerning derivatives.

Country and supplier concentrations

The Company’s products are produced by independent factories located outside the United States, principally in

Southeast Asia. Apparel is manufactured in approximately 20 countries, with Vietnam and China accounting for

approximately 67% of 2013 global apparel production. Footwear is manufactured in four countries, with China and Vietnam

accounting for approximately 99% of 2013 global footwear production. The five largest apparel factory groups accounted

for approximately 30% of 2013 global apparel production, with the largest factory group accounting for 13% of 2013 global

apparel production. The five largest footwear factory groups accounted for approximately 79% of 2013 global footwear

production, with the largest factory group accounting for 36% of 2013 global footwear production. These companies,

however, have multiple factory locations, many of which are in different countries, thus reducing the risk that unfavorable

conditions at a single factory or location will have a material adverse effect on the Company.

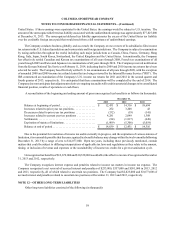

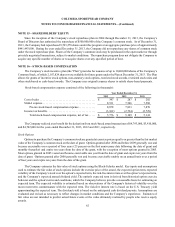

NOTE 4—NON-CONTROLLING INTEREST

The Company owns a 60% controlling interest in a joint venture formed with Swire Resources, Limited ("Swire") to

support the development of the Company's business in China. The joint venture was in a formation and start-up phase

during 2013 and began operations on January 1, 2014. In 2013, Swire made an initial capital contribution of $8,000,000

in cash, and the Company made an initial capital contribution of $12,000,000 in cash. The accounts and operations of the

joint venture are included in the Consolidated Financial Statements as of December 31, 2013. Swire's share of the net loss

of the joint venture is included in net loss attributable to non-controlling interest in the Consolidated Statements of Operations

for the year ended December 31, 2013. The 40% non-controlling equity interest in the joint venture is presented separately

in the Consolidated Balance Sheet and Consolidated Statement of Equity for the year ended December 31, 2013.

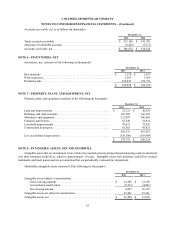

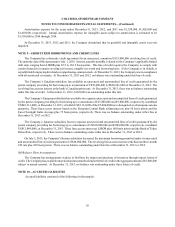

NOTE 5—ACCOUNTS RECEIVABLE, NET