Columbia Sportswear 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

58

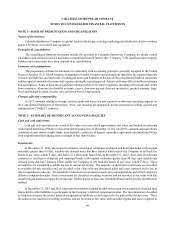

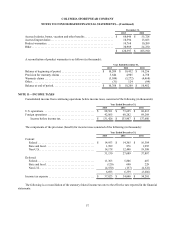

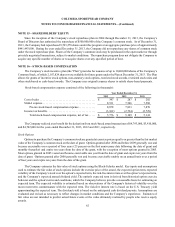

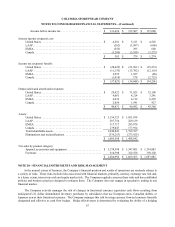

Year Ended December 31,

2013 2012 2011

(percent of income)

Provision for federal income taxes at the statutory rate. . . . . 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit. . . . . . . . 1.5 1.7 1.5

Non-U.S. income taxed at different rates. . . . . . . . . . . . . . . . (3.7) (5.4) (6.5)

Foreign tax credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.5) — (1.8)

Reduction of unrecognized tax benefits. . . . . . . . . . . . . . . . . (1.9) (4.3) (3.5)

Research credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2.1) (1.7) (0.6)

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.5 0.1 0.7

Actual provision for income taxes . . . . . . . . . . . . . . . . . . . . . 28.8% 25.4% 24.8%

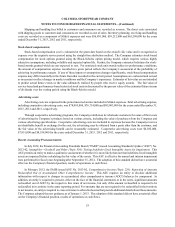

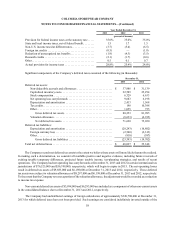

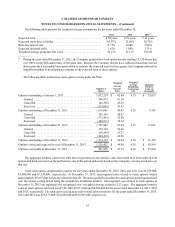

Significant components of the Company’s deferred taxes consisted of the following (in thousands):

December 31,

2013 2012

Deferred tax assets:

Non-deductible accruals and allowances . . . . . . . . . . . . . . . . . . . . . . . . . $ 37,986 $ 31,139

Capitalized inventory costs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,589 25,294

Stock compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,329 6,633

Net operating loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,683 6,198

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,413 1,568

Tax credits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 198 10,398

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,055 755

Gross deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,253 81,985

Valuation allowance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,633) (6,935)

Net deferred tax assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71,620 75,050

Deferred tax liabilities:

Depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (20,243) (16,802)

Foreign currency loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,540) (2,313)

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (810) (587)

Gross deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (23,593)(19,702)

Total net deferred taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 48,027 $ 55,348

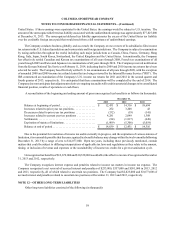

The Company records net deferred tax assets to the extent we believe these assets will more likely than not be realized.

In making such a determination, we consider all available positive and negative evidence, including future reversals of

existing taxable temporary differences, projected future taxable income, tax-planning strategies, and results of recent

operations. The Company had net operating loss carryforwards at December 31, 2013 and 2012 in certain international tax

jurisdictions of $76,525,000 and $56,749,000, respectively, which will begin to expire in 2015. The net operating losses

result in deferred tax assets of $9,683,000 and $6,198,000 at December 31, 2013 and 2012, respectively. These deferred

tax assets were subject to valuation allowances of $8,297,000 and $6,198,000 at December 31, 2013 and 2012, respectively.

To the extent that the Company reverses a portion of the valuation allowance, the adjustment would be recorded as a reduction

to income tax expense.

Non-current deferred tax assets of $3,994,000 and $6,293,000 are included as a component of other non-current assets

in the consolidated balance sheet at December 31, 2013 and 2012, respectively.

The Company had undistributed earnings of foreign subsidiaries of approximately $320,708,000 at December 31,

2013 for which deferred taxes have not been provided. Such earnings are considered indefinitely invested outside of the