Columbia Sportswear 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

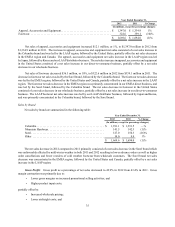

The following table presents our estimated contractual commitments (in thousands):

Year ended December 31,

2014 2015 2016 2017 2018 Thereafter Total

Inventory purchase obligations (1) . . $216,752 $ — $ — $ — $ — $ — $216,752

Operating leases (2) . . . . . . . . . . . . . . 44,689 40,298 37,301 33,962 30,511 88,926 275,687

—————

(1) See Inventory Purchase Obligations in Note 14 of Notes to Consolidated Financial Statements.

(2) See Operating Leases in Note 14 of Notes to Consolidated Financial Statements.

We have recorded long-term liabilities for net unrecognized tax benefits related to income tax uncertainties in our

Consolidated Balance Sheet at December 31, 2013 of approximately $14.0 million; however, they have not been included

in the table above because we are uncertain about whether or when these amounts may be settled. See Note 11 of Notes to

Consolidated Financial Statements.

Quantitative and Qualitative Disclosures About Market Risk

In the normal course of business, our financial position and results of operations are subject to a variety of risks,

including risks associated with global financial and capital markets, primarily currency exchange rate risk and, to a lesser

extent, interest rate risk and equity market risk. We regularly assess these risks and have established policies and business

practices designed to mitigate their effects. We do not engage in speculative trading in any financial or capital market.

Our primary currency exchange rate risk management objective is to mitigate the uncertainty of anticipated cash flows

attributable to changes in exchange rates. We focus on mitigating changes in functional currency equivalent cash flows

resulting from anticipated U.S. dollar denominated inventory purchases by subsidiaries that use European euros, Canadian

dollars, or Japanese yen as their functional currency. We manage this risk primarily by using currency forward contracts.

Additionally, we use foreign currency forward contracts to hedge net balance sheet exposures related primarily to non-

functional currency denominated monetary assets and liabilities consisting primarily of cash and cash equivalents, short-

term investments, payables and intercompany loans for subsidiaries that use euros, Canadian dollars, yen, Korean won or

Chinese renminbi as their functional currency.

The net fair value of our derivative contracts was favorable by approximately $3.7 million at December 31, 2013. A

10% unfavorable exchange rate change in the euro, Canadian dollar, yen and renminbi against the U.S. dollar would have

resulted in the net fair value declining by approximately $17.6 million at December 31, 2013. Changes in fair value resulting

from foreign exchange rate fluctuations would be substantially offset by the change in value of the underlying hedged

transactions.

Our negotiated credit facilities generally charge interest based on a benchmark rate such as the London Interbank

Offered Rate (“LIBOR”). Fluctuations in short-term interest rates cause interest payments on drawn amounts to increase

or decrease. At December 31, 2013, our credit facilities did not have an outstanding balance.

Critical Accounting Policies and Estimates

Management’s discussion and analysis of our financial condition and results of operations are based on our consolidated

financial statements, which have been prepared in accordance with accounting principles generally accepted in the United

States of America. The preparation of these financial statements requires us to make various estimates and assumptions that

affect reported amounts of assets and liabilities and related disclosure of contingent assets and liabilities at the date of the

consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. We believe

that the estimates and assumptions involved in the accounting policies described below have the greatest potential impact

on our financial statements, so we consider these to be our critical accounting policies and estimates. Because of the

uncertainty inherent in these matters, actual results may differ from the estimates we use in applying these critical accounting

policies. We base our ongoing estimates on historical experience and various other assumptions that we believe to be

important in the circumstances. Many of these critical accounting policies affect working capital account balances, including

the policy for revenue recognition, the allowance for doubtful accounts, the provision for potential excess, closeout and

slow moving inventory, product warranty, income taxes and stock-based compensation.