Columbia Sportswear 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

59

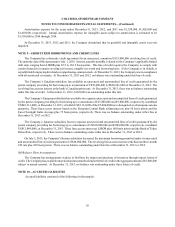

United States. If these earnings were repatriated to the United States, the earnings would be subject to U.S. taxation. The

amount of the unrecognized deferred tax liability associated with the undistributed earnings was approximately $77,825,000

at December 31, 2013. The unrecognized deferred tax liability approximates the excess of the United States tax liability

over the creditable foreign taxes paid that would result from a full remittance of undistributed earnings.

The Company conducts business globally, and as a result, the Company or one or more of its subsidiaries files income

tax returns in the U.S. federal jurisdiction and various state and foreign jurisdictions. The Company is subject to examination

by taxing authorities throughout the world, including such major jurisdictions as Canada, China, France, Germany, Hong

Kong, Italy, Japan, South Korea, Switzerland, the United Kingdom and the United States. Internationally, the Company

has effectively settled Canadian and Korean tax examinations of all years through 2008, French tax examinations of all

years through 2009 and Swiss and Japanese tax examinations of all years through 2010. The Company received notification

from the Korean National Tax Service on February 11, 2014, indicating that its 2009 and 2010 income tax returns have been

selected for audit. The Company has effectively settled U.S. tax examinations of all years through 2009, with the exception

of amended 2008 and 2009 income tax refund claims that are being reviewed by the Internal Revenue Service ("IRS"). The

IRS commenced an examination of the Company's U.S. income tax returns for 2011 and 2012 in the second quarter and

fourth quarter of 2013, respectively. It is anticipated that these examinations will be completed by the end of 2014. The

Company does not anticipate that adjustments relative to ongoing tax audits will result in a material changes to its consolidated

financial position, results of operations or cash flows.

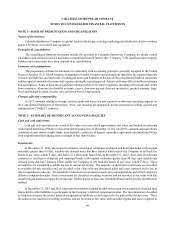

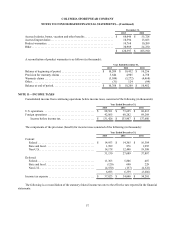

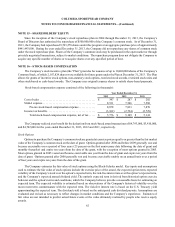

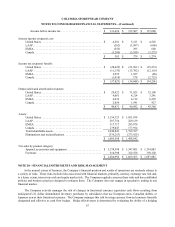

A reconciliation of the beginning and ending amount of gross unrecognized tax benefits is as follows (in thousands):

December 31,

2013 2012 2011

Balance at beginning of period . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,431 $ 14,316 $ 18,694

Increases related to prior year tax positions . . . . . . . . . . . . . . . 252 3,208 43

Decreases related to prior year tax positions. . . . . . . . . . . . . . . (332) (19) (141)

Increases related to current year tax positions . . . . . . . . . . . . . 4,281 2,049 1,388

Settlements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (84) (1,817) (649)

Expiration of statute of limitations . . . . . . . . . . . . . . . . . . . . . . (1,909) (5,306) (5,019)

Balance at end of period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 14,639 $ 12,431 $ 14,316

Due to the potential for resolution of income tax audits currently in progress, and the expiration of various statutes of

limitation, it is reasonably possible that the unrecognized tax benefits balance may change within the twelve months following

December 31, 2013 by a range of zero to $14,077,000. Open tax years, including those previously mentioned, contain

matters that could be subject to differing interpretations of applicable tax laws and regulations as they relate to the amount,

timing, or inclusion of revenue and expenses or the sustainability of income tax credits for a given examination cycle.

Unrecognized tax benefits of $12,679,000 and $10,328,000 would affect the effective tax rate if recognized at December

31, 2013 and 2012, respectively.

The Company recognizes interest expense and penalties related to income tax matters in income tax expense. The

Company recognized a net reversal of accrued interest and penalties of $253,000, $357,000 and $501,000 in 2013, 2012

and 2011, respectively, all of which related to uncertain tax positions. The Company had $2,823,000 and $3,077,000 of

accrued interest and penalties related to uncertain tax positions at December 31, 2013 and 2012, respectively.

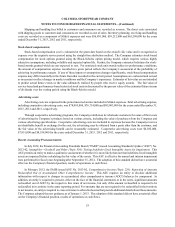

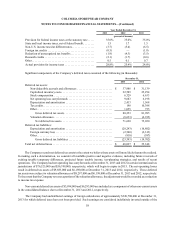

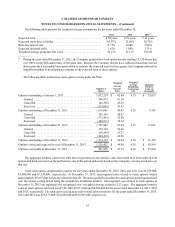

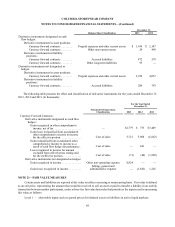

NOTE 12—OTHER LONG-TERM LIABILITIES

Other long-term liabilities consisted of the following (in thousands):