Columbia Sportswear 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

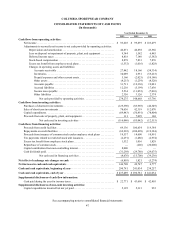

Net cash used in investing activities was $116.1 million in 2013 compared to $85.0 million in 2012. For 2013, net

cash used in investing activities primarily consisted of $69.4 million for capital expenditures, including development of our

ongoing global ERP system, project and maintenance capital expenditures and investments in our direct-to-consumer

business, and $46.8 million for net purchases of short-term investments. For 2012, net cash used in investing activities

primarily consisted of $50.5 million for capital expenditures and $41.7 million for net purchases of short-term investments.

Net cash used in financing activities was $4.7 million in 2013 compared to $15.7 million in 2012. For 2013, net cash

used in financing activities primarily consisted of dividend payments of $31.3 million, partially offset by net proceeds of

$17.2 million from the issuance of common stock related to our stock compensation programs and an $8.0 million capital

contribution from our China joint venture partner, which was recorded in equity as a non-controlling interest. For 2012,

net cash used in financing activities primarily consisted of dividend payments of $29.8 million, partially offset by net

proceeds of $13.1 million from the issuance of common stock.

2012 compared to 2011

Net cash provided by operating activities was $148.7 million in 2012 compared to $63.8 million in 2011. The increase

in cash provided by operating activities was primarily due to decreases in accounts receivable and inventory for the year

ended December 31, 2012, compared to increases in the prior year; partially offset by a decrease in accounts payable and

accrued liabilities for the year ended December 31, 2012 compared to an increase in 2011.

Net cash used in investing activities was $85.0 million in 2012 compared to $12.5 million in 2011. For 2012, net

cash used in investing activities primarily consisted of $50.5 million for capital expenditures and $41.7 million for net

purchases of short-term investments. For 2011, net cash used in investing activities primarily consisted of $78.4 million

for capital expenditures, including the acquisition of a new distribution center and headquarters facility in Canada, partially

offset by $65.7 million for net sales of short-term investments.

Net cash used in financing activities was $15.7 million in 2012 compared to $39.2 million in 2011. For 2012, net

cash used in financing activities primarily consisted of dividend payments of $29.8 million, partially offset by net proceeds

of $13.1 million from the issuance of common stock. For 2011, net cash used in financing activities primarily consisted of

dividend payments of $29.1 million and the repurchase of common stock at an aggregate price of $20.0 million, partially

offset by net proceeds of $8.0 million from the issuance of common stock.

Short-term borrowings and credit lines

We have an unsecured, committed $125.0 million revolving line of credit available to fund our domestic working

capital requirements. At December 31, 2013, no balance was outstanding under this line of credit and we were in compliance

with all associated covenants. Internationally, our subsidiaries have operating lines of credit in place guaranteed by the

parent company with a combined limit of approximately $103.4 million at December 31, 2013, of which $3.2 million is

designated as a European customs guarantee. At December 31, 2013, there was no balance outstanding under these lines

of credit.

We expect to fund our future working capital expenditures with existing cash, operating cash flows and credit facilities.

If the need arises, we may need to seek additional funding. Our ability to obtain additional financing will depend on many

factors, including prevailing market conditions, our financial condition, and our ability to negotiate favorable terms and

conditions. Financing may not be available on terms that are acceptable or favorable to us, if at all.

Our operations are affected by seasonal trends typical in the outdoor apparel and footwear industry and have historically

resulted in higher sales and profits in the third and fourth calendar quarters. This pattern has resulted primarily from the

timing of shipments of fall season products to wholesale customers in the third and fourth quarters and proportionally higher

sales in our direct-to-consumer operations in the fourth quarter, combined with an expense base that is spread more evenly

throughout the year. We believe that our liquidity requirements for at least the next 12 months will be adequately covered

by existing cash, cash provided by operations and existing short-term borrowing arrangements.

Contractual obligations