Columbia Sportswear 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

53

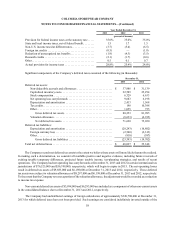

Shipping and handling fees billed to customers and consumers are recorded as revenue. The direct costs associated

with shipping goods to customers and consumers are recorded as cost of sales. Inventory planning, receiving and handling

costs are recorded as a component of SG&A expenses and were $56,891,000, $59,212,000 and $65,290,000 for the years

ended December 31, 2013, 2012 and 2011, respectively.

Stock-based compensation:

Stock-based compensation cost is estimated at the grant date based on the award’s fair value and is recognized as

expense over the requisite service period using the straight-line attribution method. The Company estimates stock-based

compensation for stock options granted using the Black-Scholes option pricing model, which requires various highly

subjective assumptions, including volatility and expected option life. Further, the Company estimates forfeitures for stock-

based awards granted which are not expected to vest. For restricted stock unit awards subject to performance conditions,

the amount of compensation expense recorded in a given period reflects the Company's assessment of the probability of

achieving its performance targets. If any of these inputs or assumptions changes significantly, stock-based compensation

expense may differ materially in the future from that recorded in the current period. Assumptions are evaluated and revised

as necessary to reflect changes in market conditions and the Company’s experience. Estimates of fair value are not intended

to predict actual future events or the value ultimately realized by people who receive equity awards. The fair value of

service-based and performance-based restricted stock units is discounted by the present value of the estimated future stream

of dividends over the vesting period using the Black-Scholes model.

Advertising costs:

Advertising costs are expensed in the period incurred and are included in SG&A expenses. Total advertising expense,

including cooperative advertising costs, was $78,095,000, $76,714,000 and $85,003,000 for the years ended December 31,

2013, 2012 and 2011, respectively.

Through cooperative advertising programs, the Company reimburses its wholesale customers for some of their costs

of advertising the Company’s products based on various criteria, including the value of purchases from the Company and

various advertising specifications. Cooperative advertising costs are included in expenses because the Company receives

an identifiable benefit in exchange for the cost, the advertising may be obtained from a party other than the customer, and

the fair value of the advertising benefit can be reasonably estimated. Cooperative advertising costs were $6,032,000,

$7,851,000 and $8,554,000 for the years ended December 31, 2013, 2012 and 2011, respectively.

Recent Accounting Pronouncements:

In July 2012, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No.

2012-02, Intangibles—Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment. This

ASU permits an entity to make a qualitative assessment of whether it is more likely than not that indefinite-lived intangible

assets are impaired before calculating the fair value of the assets. This ASU is effective for annual and interim impairment

tests performed for fiscal years beginning after September 15, 2012. The adoption of this standard did not have a material

effect on the Company's financial position, results of operations or cash flows.

In February 2013, the FASB issued ASU No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts

Reclassified Out of Accumulated Other Comprehensive Income. This ASU requires an entity to disclose additional

information with respect to changes in accumulated other comprehensive income (AOCI) balances by component. In

addition, an entity is required to present, either on the face of the financial statements or in the notes, significant amounts

reclassified out of AOCI by the respective line items of net income, but only if the amount reclassified is required to be

reclassified in its entirety in the same reporting period. For amounts that are not required to be reclassified in their entirety

to net income, an entity is required to cross-reference to other disclosures that provide additional details about those amounts.

The Company adopted the new guidance as of January 1, 2013. The adoption of this standard did not have a material effect

on the Company's financial position, results of operations or cash flows.