Columbia Sportswear 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

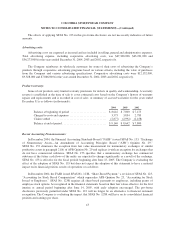

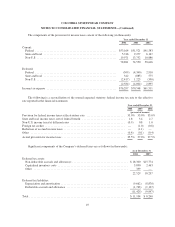

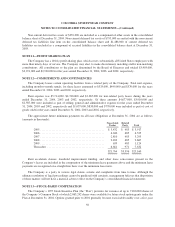

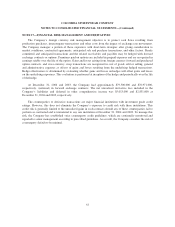

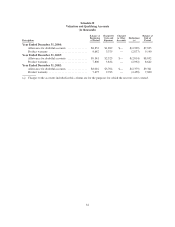

The following table summarizes information about stock options outstanding at December 31, 2004:

Options Outstanding Options Exercisable

Range of Exercise

Prices Number of Shares

Weighted Average

Remaining

Contractual Life

(yrs)

Weighted Average

Exercise Price Number of Shares

Weighted Average

Exercise Price

$ 6.45 - 9.67 133,100 2.02 $ 7.23 133,100 $ 7.23

$ 10.13 - 13.08 173,622 3.34 12.55 159,851 12.58

$ 15.71 - 18.13 172,248 4.42 17.78 129,501 17.81

$ 22.71 - 33.69 599,526 6.24 32.51 326,406 31.98

$ 34.20 - 42.88 544,565 6.41 37.97 265,811 38.04

$ 43.93 - 47.91 81,558 6.60 45.26 51,535 45.04

$ 52.75 - 58.08 571,385 8.38 53.26 6,777 53.12

2,276,004 6.23 $35.37 1,072,981 $26.57

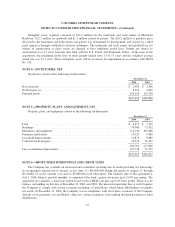

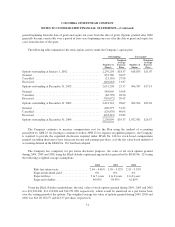

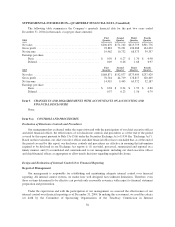

NOTE 14—EARNINGS PER SHARE

SFAS No. 128, “Earnings per Share” requires dual presentation of basic and diluted earnings per share

(“EPS”). Basic EPS is based on the weighted average number of common shares outstanding. Diluted EPS

reflects the potential dilution that could occur if securities or other contracts to issue common stock were

exercised or converted into common stock.

There were no adjustments to net income in computing diluted earnings per share for the years ended

December 31, 2004, 2003 and 2002. A reconciliation of the common shares used in the denominator for

computing basic and diluted earnings per share is as follows (in thousands, except per share amounts):

Year Ended December 31,

2004 2003 2002

Weighted average common shares outstanding, used in computing basic earnings

pershare ........................................................ 40,266 39,953 39,449

Effect of dilutive stock options ........................................ 546 638 614

Weighted-average common shares outstanding, used in computing diluted

earnings per share ................................................. 40,812 40,591 40,063

Earnings per share of common stock:

Basic ........................................................... $ 3.44 $ 3.01 $ 2.60

Diluted ......................................................... 3.40 2.96 2.56

Options to purchase an additional 10,000, 8,000 and 839,000 shares of common stock were outstanding at

December 31, 2004, 2003 and 2002, respectively, but were not included in the computation of diluted earnings

per share because their effect would be anti-dilutive.

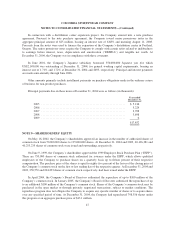

In June 2003, the Company repurchased 234,831 unvested shares of its common stock awarded to a former

key employee under a Deferred Compensation Conversion Agreement (the “Agreement”). The repurchase cost

was approximately $498,000 and was accounted for as a reduction to shareholders’ equity. As provided in the

Agreement and because the executive’s employment terminated January 3, 2003, the unvested shares would vest

automatically unless the executive was compensated by the Company within 180 days from termination date.

52