Columbia Sportswear 2004 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Canada’s net sales increased $10.2 million, or 9.6%, to $116.9 million in 2004 from $106.7 million in 2003.

Excluding changes in currency exchange rates, Canada’s net sales increased 2.0%. Net sales growth was led by

footwear, followed by sportswear, while sales of accessories and outerwear decreased during the year. Footwear

sales grew in all key product classes, led by boots, followed by shoes and sandals. Sales of sportswear also

increased in all key product classes, led by knitted and woven tops, followed by pants, sweaters and shorts.

Unseasonable winter weather conditions negatively affected outerwear sales in the fourth quarter. Our maturity

in the Canadian outerwear market also makes sales growth more challenging.

Net sales from Other International, which includes our direct business in Japan and Korea and our

international distributor markets worldwide, increased $28.3 million, or 25.0%, to $141.4 million in 2004 from

$113.1 million in 2003. Excluding changes in currency exchange rates, Other International sales increased

21.7%. Net sales grew across all product categories, led by outerwear, followed by sportswear, accessories,

equipment and footwear. Outerwear and sportswear sales growth was particularly strong in our international

distributor-based markets, while our business in Korea contributed to the increase in sales of accessories.

Footwear sales increased less in Other International than in other geographic regions primarily due to the poor

sell-through of cold weather footwear in Russia in 2003 as a result of mild weather conditions.

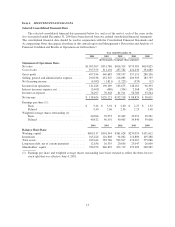

Gross Profit: Gross profit as a percentage of net sales decreased to 45.5% in 2004 from 46.3% in 2003.

The decrease in gross profit was primarily the result of the continued shift in our sales product mix both between

and within product categories. The unfavorable gross profit effect of shifts in our sales product mix was partially

offset by foreign currency exchange rate fluctuations as foreign currencies in our direct markets appreciated

against the U.S. dollar.

A shift in our sales product mix from our traditional outerwear products to sportswear and footwear

continued to have an unfavorable impact on our gross profit throughout 2004. This shift in sales product mix was

anticipated due to our growth strategy to further develop and expand our product categories. Moreover, as a

result of our growth strategies, increases in sales of sportswear and footwear outpaced sales growth from

outerwear. Sales product mix affects our gross profits because our outerwear products generally carry higher

gross profits than other product categories. In 2004, outerwear sales represented 42.0% of net sales compared to

46.6% of 2003 net sales. Sportswear and footwear sales represented 36.2% and 16.9% of net sales in 2004,

respectively, compared to 32.7% and 15.6% of net sales in 2003, respectively. In the future, we anticipate the

shift in sales product mix will continue to exert pressure on our gross profits.

Our gross profit also decreased due to shifts in sales product mix within our product categories. Shifts in

sales product mix is a factor within each of our product categories especially the outerwear category where there

has been a general consumer trend to purchase lighter-weight, lower margin outerwear products and heavier

sportswear products, such as fleece sweaters, vests and pullovers.

The unfavorable impacts on gross profit from product mix shifts were partially offset by the appreciation of

many foreign currencies against the U.S. dollar. Since our global supply of inventory is generally purchased with

U.S. dollars, our foreign businesses have benefited from the decreasing value of the U.S. dollar. This favorable

gross profit impact has been most noticeable in our European, Canadian and Japanese businesses.

Our gross profits may not be comparable to those of other companies in our industry because some entities

include all of the costs related to their distribution network in cost of sales. Some companies such as ours,

however, have chosen to include these expenses as a component of selling, general and administrative expense.

Selling, General and Administrative Expense: Selling, general and administrative expense (“SG&A”)

includes all costs associated with our design, marketing, distribution and corporate functions including

depreciation and amortization.

18