Columbia Sportswear 2004 Annual Report Download - page 44

Download and view the complete annual report

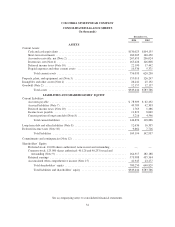

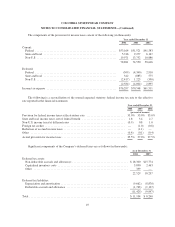

Please find page 44 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

their highly liquid nature and because such marketable securities represent the investment of cash that is

available for current operations. All cash and short-term investments are classified as available-for-sale securities

and are recorded at fair value with any unrealized gains and losses reported, net of tax, in other comprehensive

income. Realized gains or losses are determined based on the specific identification method. The Company has

no investments considered to be trading securities. The carrying value of available-for-sale securities

approximates fair market value due to their short maturities.

Accounts receivable:

Accounts receivable have been reduced by an allowance for doubtful accounts, which was $7,825,000 and

$8,852,000 at December 31, 2004 and 2003, respectively. The provision for bad debt expense was $1,882,000,

$2,325,000 and $3,704,000 in 2004, 2003, and 2002, respectively. The charges to the reserve were $2,909,000,

$2,814,000 and $2,379,000 in 2004, 2003 and 2002, respectively.

Inventories:

Inventories are carried at the lower of cost or market. Cost is determined using the first-in, first-out method.

The Company periodically reviews its inventories for excess, close-out or slow moving items and makes

provisions as necessary to properly reflect inventory value.

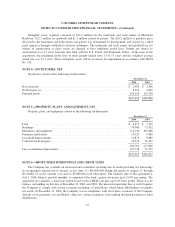

Property, plant, and equipment:

Property, plant, and equipment are stated at cost. Depreciation of buildings, machinery and equipment,

furniture and fixtures and amortization of leasehold improvements is provided using the straight-line method

over the estimated useful lives of the assets. The principal estimated useful lives are: buildings, 30 years;

machinery and equipment, 3-6 years; and furniture and fixtures, 3-8 years. Leasehold improvements are

amortized over the lesser of the estimated useful life of the improvement or the remaining term of the underlying

lease.

The interest-carrying costs of capital assets under construction are capitalized based on the Company’s

weighted average borrowing rates. Capitalized interest was $996,000, $226,000 and $1,000,000 in 2004, 2003

and 2002, respectively.

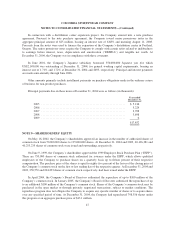

Intangible assets:

The Company adopted Statement of Financial Accounting Standards (“SFAS”) No. 142, “Goodwill and

Other Intangible Assets,” effective January 1, 2002. In accordance with SFAS No. 142, certain intangible assets

with indefinite useful lives are no longer being amortized and are periodically evaluated for impairment. Certain

intangible assets that are determined to have finite lives continue to be amortized over their useful lives.

39