Columbia Sportswear 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

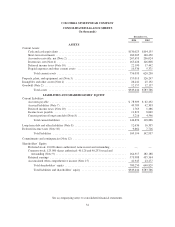

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

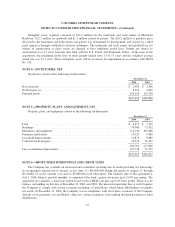

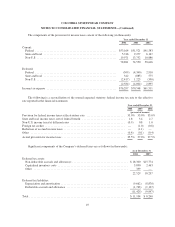

The following table summarizes the Company’s identifiable intangible assets balance (in thousands):

December 31, 2004 December 31, 2003

Carrying

Amount

Accumulated

Amortization

Carrying

Amount

Accumulated

Amortization

Intangible assets subject to amortization:

Patents .......................................... $ 1,200 $(147) $ 1,200 $(63)

Intangible assets not subject to amortization:

Trademarks and trade names ........................ $21,971 $21,971

Goodwill ........................................ 12,157 12,157

$34,128 $34,128

Amortization expense for intangible assets subject to amortization is estimated to be $84,000 in each of

2005, 2006, 2007, 2008 and 2009.

Other non-current assets totaled $3,217,000 and $2,024,000 at December 31, 2004 and 2003, respectively.

Impairment of long-lived and intangible assets:

In accordance with SFAS No. 142, goodwill and intangible assets with indefinite useful lives are no longer

amortized but instead are measured for impairment at least annually or when events indicate that an impairment

exists. The Company reviews and tests its goodwill and intangible assets for impairment in the fourth quarter of

each year and when events or changes in circumstances indicate that the carrying amount of such assets may be

impaired. Determination of fair value is based on estimated discounted future cash flows resulting from the use

of the asset. The Company compares the estimated fair value of goodwill and intangible assets to the carrying

value. If the carrying value exceeds the estimate of fair value, the Company calculates impairment as the excess

of the carrying value over the estimated fair value. The estimates of fair value in goodwill and indefinite-lived

intangible asset tests are based on a number of factors, including assumptions and estimates for projected sales,

income, cash flows, and other operating performance measures. These assumptions and estimates may change in

the future due to changes in economic conditions, in the Company’s ability to meet sales and profitability

objectives, or changes in the Company’s business operations or strategic direction.

Long lived and intangible assets that are determined to have finite lives will continue to be amortized over

their useful lives and are measured for impairment only when events or circumstances indicate the carrying value

may be impaired. In these cases, the Company estimates the future undiscounted cash flows to be derived from

the asset to determine whether a potential impairment exists. If the carrying value exceeds the estimate of future

undiscounted cash flows, the Company then calculates the impairment as the excess of the carrying value of the

asset over the estimate of its fair value. Any impairment charge would be classified as a component of selling,

general, and administrative expense.

The Company has determined that its long-lived assets at December 31, 2004 and 2003 were not impaired.

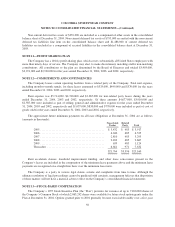

Deferred income taxes:

United States income taxes are provided currently on financial statement earnings of non-U.S. subsidiaries

expected to be repatriated. The Company determines annually the amount of undistributed non-U.S. earnings to

invest indefinitely in its non-U.S. operations. Deferred income taxes are provided for temporary differences

40