Columbia Sportswear 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

limit of approximately $61.9 million at December 31, 2004. There were no balances outstanding under these

lines of credit at December 31, 2004.

Additionally, we maintain unsecured and uncommitted lines of credit with a combined limit of $275 million

at December 31, 2004, available for issuing letters of credit. At December 31, 2004, the balance outstanding

under these letters of credit was $90.1 million.

As we continue our investment in global infrastructure to support our growth, we anticipate that capital

expenditures for 2005 will total approximately $40 million, consisting of maintenance capital requirements and

information technology and distribution projects. We expect to fund these capital expenditures with existing cash

and cash provided by operations. If the need arises for additional expenditures, we may need to seek additional

funding. Our ability to obtain additional credit facilities will depend on many factors, including prevailing market

conditions, our financial condition, and our ability to negotiate favorable terms and conditions. We do not assure

you that financing will be available on terms that are acceptable or favorable to us, if at all.

Our operations are affected by seasonal trends typical in the outdoor apparel industry, and have historically

resulted in higher sales and profits in the third calendar quarter. This pattern has resulted primarily from the

timing of shipments to wholesale customers for the fall outerwear season. We believe that our liquidity

requirements for at least the next 12 months will be adequately covered by existing cash, cash provided by

operations and existing short-term borrowing arrangements.

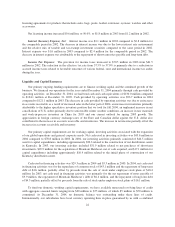

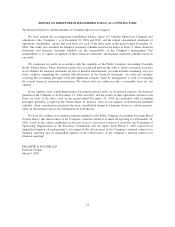

The following table presents our estimated contractual commitments (in thousands):

Year ending December 31,

2005 2006 2007 2008 2009 Thereafter Total

Debtrepayments ..................... $4,646 $4,646 $3,571 $3,571 $— $ — $16,434

Other(1) ........................... 570 578 137 127 6 — 1,418

Operating leases (2):

Non-related parties ............... 5,432 4,040 2,810 2,182 639 6,661 21,764

Related party .................... 485 485 485 485 485 971 3,396

(1) Other amounts primarily include installment payments on purchase obligations made in the ordinary course

of business for non-product purchases. The amounts represent the minimum payments required by legally

binding contracts and agreements.

(2) These operating lease commitments are not reflected on the consolidated balance sheet under accounting

principles generally accepted in the United States.

Quantitative and Qualitative Disclosures About Market Risk

We are exposed to market risks from fluctuations of foreign currency exchange rates and interest rates as a

result of our international sales, production and funding requirements. Our policy is to use financial instruments

to reduce market risk where internal netting and other strategies cannot be effectively employed. Foreign

currency and interest rate transactions are used only to the extent considered necessary to meet our objectives.

We do not enter into foreign currency or interest rate transactions for speculative purposes.

Our foreign currency risk management objective is to protect cash flows resulting from production

purchases, intercompany transactions and other costs from exchange rate movements. We manage this risk

primarily by using forward exchange contracts and options to hedge various firm as well as anticipated

commitments and the related receivables and payables, including third party or intercompany transactions.

Anticipated, but not yet firmly committed, transactions that we hedge carry a high level of certainty and are

expected to be recognized within one year. We use cross-currency swaps to hedge foreign currency denominated

23