Columbia Sportswear 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

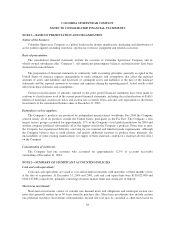

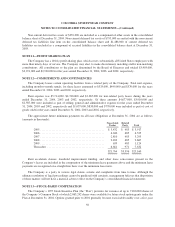

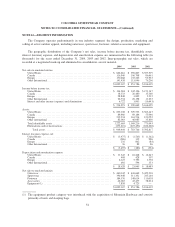

NOTE 10—INCOME TAXES

The Company applies an asset and liability method for income taxes that requires the recognition of

deferred tax assets and liabilities for the expected future tax consequences of events that have been recognized in

the Company’s financial statements or tax returns. In estimating future tax consequences, the Company generally

considers all expected future events other than enactment of changes in the tax laws or rates. Deferred taxes are

provided for temporary differences between assets and liabilities for financial reporting purposes and for income

tax purposes. Valuation allowances are recorded against net deferred tax assets when it is more likely than not

that the asset will not be realized.

The Company has undistributed earnings of foreign subsidiaries of approximately $110,000,000 at

December 31, 2004, for which deferred taxes have not been provided. Such earnings are considered indefinitely

invested outside of the United States. If these earnings were repatriated to the United States, the earnings would

be subject to U.S. taxation. The amount of unrecognized deferred tax liability associated with the undistributed

earnings was approximately $12,000,000 at December 31, 2004. The unrecognized deferred tax liability is the

approximate excess of the United States tax liability over the creditable foreign taxes paid that would result from

a full remittance of undistributed earnings.

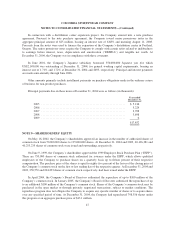

On October 22, 2004, the American Jobs Creation Act of 2004 (the “Act”) was signed into law. The Act

includes a deduction from taxable income of 85% of certain foreign earnings that are repatriated, as defined in

the Act. During 2005, the Company may elect to apply this provision to qualifying repatriations of foreign

subsidiary earnings which are currently considered as permanently reinvested under the exception provided by

APB No. 23, “Accounting for Income Taxes—Special Areas.” Absent the Act provisions, these earnings would

likely not be repatriated in the foreseeable future. The Company is evaluating the effects of the repatriation

provisions based on all available U.S. Treasury guidance and is awaiting anticipated further guidance. The

Company expects to complete its evaluation of the effects of the repatriation provision within a reasonable period

of time after additional guidance is published. The Company is estimating that the range of possible amounts

considered for repatriation under this provision is between $0 and $150 million. The related potential range of

income tax is subject to various factors and will become determinable once further guidance has been issued.

In November 2004, the Internal Revenue Service commenced an examination of the Company’s 2002 and

2003 U.S. federal income tax returns.

The Company receives a U.S. income tax benefit upon the exercise of the majority of its employee stock

options. The benefit is equal to the difference between the fair market value of the stock at the time of exercise

and the option price, times the appropriate tax rate. The Company has recorded the benefit associated with the

exercise of employee stock options directly to shareholders’ equity.

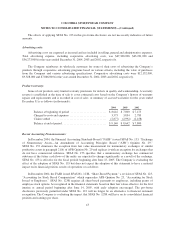

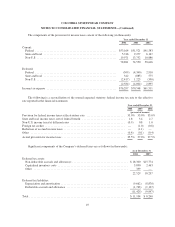

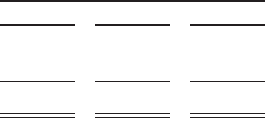

Consolidated income from continuing operations before income taxes consists of the following (in

thousands):

Year ended December 31

2004 2003 2002

U.S. operations .................................................. $141,493 $147,738 $136,186

Foreign operations ............................................... 73,428 42,931 27,843

Incomebeforeincometax ..................................... $214,921 $190,669 $164,029

48