Columbia Sportswear 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

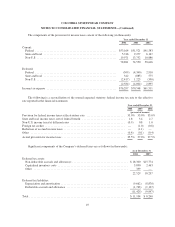

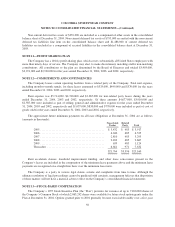

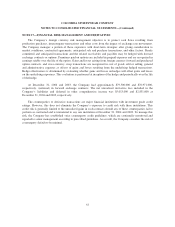

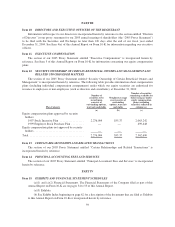

The components of the provision for income taxes consist of the following (in thousands):

Year ended December 31

2004 2003 2002

Current:

Federal ......................................................... $53,164 $51,521 $41,583

State and local ................................................... 5,746 9,277 6,147

Non-U.S......................................................... 19,971 13,752 10,886

78,881 74,550 58,616

Deferred:

Federal ......................................................... (509) (4,340) 2,910

State and local ................................................... 342 (885) 575

Non-U.S......................................................... (2,417) 1,223 (590)

(2,584) (4,002) 2,895

Incometaxexpense ................................................. $76,297 $70,548 $61,511

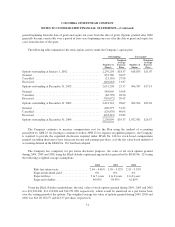

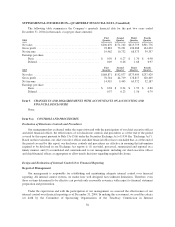

The following is a reconciliation of the normal expected statutory federal income tax rate to the effective

rate reported in the financial statements:

Year ended December 31

2004 2003 2002

(percent of income)

Provision for federal income taxes at the statutory rate ........................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit .............................. 1.8 3.4 2.7

Non-U.S. income taxed at different rates ...................................... (0.9) 0.8 1.0

Foreign tax credits ........................................................ — (1.0) (0.8)

Reduction of accrued income taxes ........................................... — (1.1) —

Other .................................................................. (0.4) (0.1) (0.4)

Actual provision for income taxes ............................................ 35.5% 37.0% 37.5%

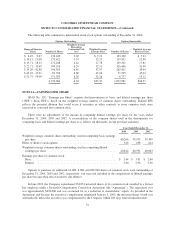

Significant components of the Company’s deferred taxes are as follows (in thousands):

As of December 31

2004 2003

Deferred tax assets:

Non-deductible accruals and allowances ....................................... $18,300 $15,774

Capitalized inventory costs ................................................. 3,890 2,463

Other .................................................................. 339 —

22,529 18,237

Deferred tax liabilities:

Depreciation and amortization ............................................... (9,662) (8,870)

Deductible accruals and allowance ........................................... (1,763) (1,127)

(11,425) (9,997)

Total ..................................................................... $11,104 $ 8,240

49