Columbia Sportswear 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

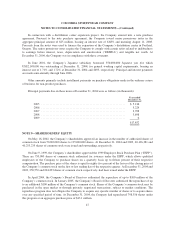

Intangible assets acquired consisted of $15.0 million for the trademark and trade names of Mountain

Hardwear, $12.2 million for goodwill and $1.2 million related to patents. The $16.2 million of purchase price

allocated to the trademark and trade names and patents was determined by management, and in part, by a third

party appraiser through established valuation techniques. The trademark and trade names and goodwill are not

subject to amortization as these assets are deemed to have indefinite useful lives. Patents are subject to

amortization over 17 years from the date filed with the U.S. Patent and Trademark Office. At the time of the

acquisition, the remaining useful lives of these patents ranged from 13 to 15 years and the weighted average

useful life was 14.3 years. These intangible assets will be reviewed for impairment in accordance with SFAS

No. 142.

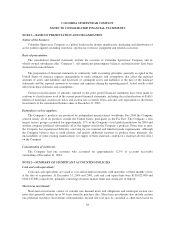

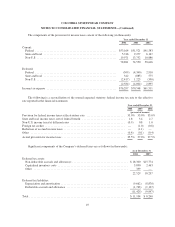

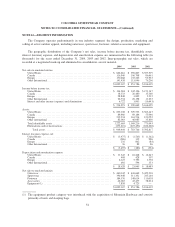

NOTE 4—INVENTORIES, NET

Inventories consist of the following (in thousands):

December 31,

2004 2003

Raw materials ............................................................ $ 2,905 $ 3,386

Work in process ........................................................... 8,323 3,692

Finished goods ............................................................ 154,198 119,730

$165,426 $126,808

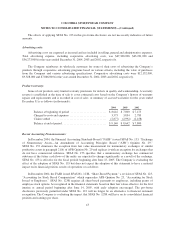

NOTE 5—PROPERTY, PLANT, AND EQUIPMENT, NET

Property, plant, and equipment consist of the following (in thousands):

December 31,

2004 2003

Land.................................................................... $ 8,379 $ 7,312

Buildings ................................................................ 74,906 73,332

Machineryandequipment ................................................... 112,540 105,666

Furnitureandfixtures ...................................................... 10,529 9,460

Leasehold improvements .................................................... 10,873 9,889

Construction in progress .................................................... 45,534 12,147

262,761 217,806

Less accumulated depreciation ............................................... 107,748 91,559

$155,013 $126,247

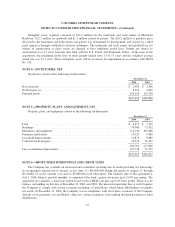

NOTE 6—SHORT-TERM BORROWINGS AND CREDIT LINES

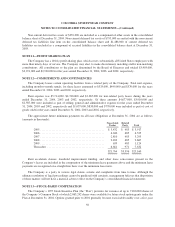

The Company has available an unsecured and committed operating line of credit providing for borrowings

in an aggregate amount not to exceed, at any time, (1) $50,000,000 during the period of August 15 through

November 14 of the calendar year and (2) $5,000,000 at all other times. The maturity date of this agreement is

July 1, 2006. Interest, payable monthly, is computed at the bank’s prime rate minus up to 2.05% per annum. The

agreement also includes a fixed rate option based on the LIBOR rate plus up to 65 basis points. There was no

balance outstanding on this line at December 31, 2004 and 2003. The unsecured operating line of credit requires

the Company to comply with certain covenants including a Capital Ratio, which limits indebtedness to tangible

net worth. At December 31, 2004, the Company was in compliance with all of these covenants. If the Company

defaults on its payments, it is prohibited, subject to certain exceptions, from making dividend payments or other

distributions.

45